Master the Art of Converting PDF Bank Statements to Excel: Tips and Tools for Data Extraction Experts

Learn how to convert bank statements from pdf to excel using Docsumo. Get insights on best practices for managing and storing your converted Excel/CSV bank statements. Simplify your operations with automated data extraction, saving time and reducing errors.

Financial data in Excel formats helps businesses perform complex calculations, create budgets, and finalize business decisions. However, converting this data from bank statements is time-consuming as you need to convert the PDF file to MS Word and then export this data to your spreadsheets.

Businesses have started using automated bank statement conversion tools to reduce human efforts and errors. Automation tools extract and convert data from PDF into Excel format within 45-60 seconds, and your staff can validate the final data.

This blog discusses the need to convert bank statements to Excel format, preparation techniques, and a detailed step-by-step process to convert PDF statements to Excel format.

Understanding the need for converting bank statements from PDF Format to Excel/CSV

With bank statement analysis, businesses can track income and expenses, find ways to reduce losses, and identify trends to increase their revenue. Financial data in Excel makes it convenient for companies to access and analyze it.

Use cases for Converting Bank Statements to Excel

Accounting

Converting bank statements to Excel allows businesses to track income and expenses, organize financial data, and identify patterns. More than 63% of companies consider Excel a vital accounting tool.

Excel offers built-in formulas such as IF, SUM, and AVERAGE to automate and perform complex calculations. For example, businesses can easily use SUM operations to calculate the income or expenses for a particular period.

Financial reporting

Data in Excel format allows businesses to create detailed financial reports using pivot tables. Use pivot tables to summarize large datasets into tables, analyze data, and derive insights for business operations.

Excel also offers chart views such as bar charts, pie charts, bubble chart, and graphs for financial data representation. Identify trends and patterns in your revenue or expenses and present them as charts effectively.

Loan application processing

A Forbes study shows that over 68% of Americans applied for a personal loan in 2023. Converting bank statements to Excel helps lenders and banks calculate loan amounts effectively.

After verifying the borrower's income, lenders use Excel formulas to determine interest rates and monthly EMIs that best suit their borrowers. This way, lenders streamline the loan application process and approve loans in a quick turnaround time.

Preparing your PDF bank statements for conversion

The first step before converting data from PDF to Word is organizing and cleaning bank statements.

Conversion software uses Optical Character Recognition (OCR) technology to read, recognize, and convert data. However, OCR cannot extract the data efficiently if the document ingested is noisy and of low or no quality. Cleaning the bank statements helps the OCR extract data with 99% accuracy.

Here are the 5 essential steps to clean the statements before starting data conversion.

1. Clear scanning

When scanning paper bank statements, ensure that dust is wiped off and pay attention to the lighting of the surroundings and the quality of the cameras. Keep the documents flat and complete scanning using a high-resolution scanner.

Organize these scanned statements in a folder to quickly ingest them in the conversion tool. Follow the same process for organizing digital bank statements.

2. Binarization

The binarization process converts grayscale or colored documents into black and white pixels (pixel values 0 and 255, respectively). Black pixels are characters that need processing, and white pixels don't require any recognition. This creates a distinction for OCR to read the characters in the statement (black pixels) and leave the background (white pixels).

3. Deskewing

The deskewing process removes the skew in the document by rotating it in a clockwise or anti-clockwise direction by the angle of its skew. Automation tools use the Projection Profile, topline, and Hough transformation methods to align the images and texts in the bank statements.

Join the waitlist and use Docsumo's free PDF deskew tool to correct the alignment errors in your bank statements.

4. Noise removal

The denoising process removes unnecessary elements such as lines and boxes, shadows, blur, blemishes, and unwanted patches in the bank statements. This process removes even tiny dots with higher intensity so that OCR doesn't recognize them as characters.

5. Increase contrast and density

Adjust the contrast and density of the bank statements to make the data more evident. This helps the OCR to extract data accurately. Different software complete these preprocessing techniques and prepare your bank statements for conversion.

But, we recommend investing in an automation tool with IDP (Intelligent Document Processing) technology, as it automatically carries out the preprocessing methods.

Step-by-step guide to converting bank statements from PDF to Excel/CSV

Online tools convert PDF bank statements to Excel/CSV. Some of these tools use traditional OCR, where any slight variation in the template of the documents leads to inaccuracy.

But, unlike other tools, Docsumo for bank statement data extraction uses IDP technology to extract and convert data. This technology overcomes the limitations of OCR by integrating it with Artificial Intelligence (AI) and Machine Learning (ML) technologies.

Docsumo learns and adapts to different formats and templates of bank statements, extracting data with over 99% accuracy rate. The extracted data undergoes validation automatically, and then the underwriters or team members can review errors and inconsistencies. The processed data is further sent to downstream apps.

Here is a detailed step-by-step process of how to convert PDF bank statements to Excel format using Docsumo:

1. Sign up on Docsumo

Sign up for a free trial of Docsumo, and you can process, extract, and convert 100 bank statements for free. Use your work email and set a strong password to start processing.

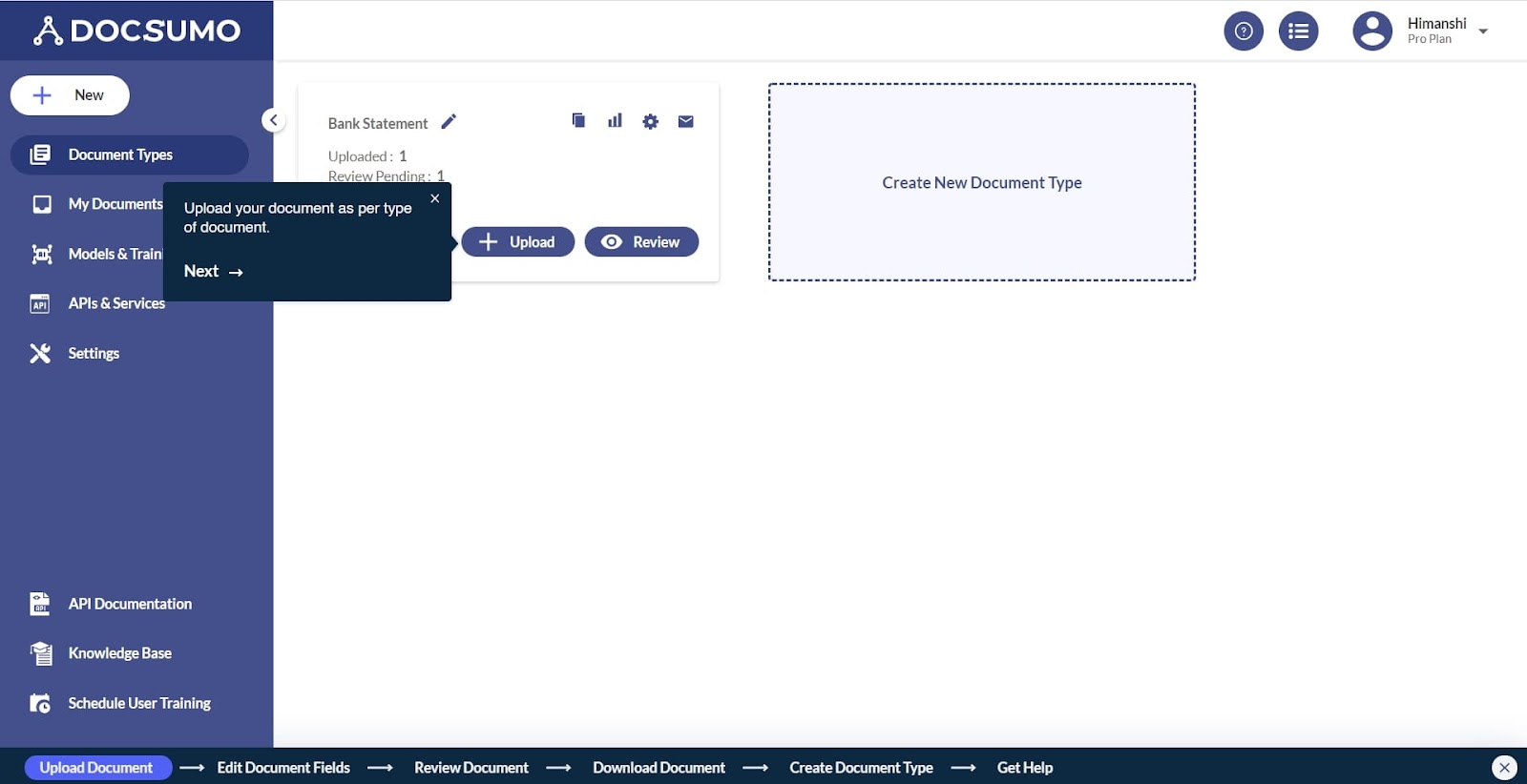

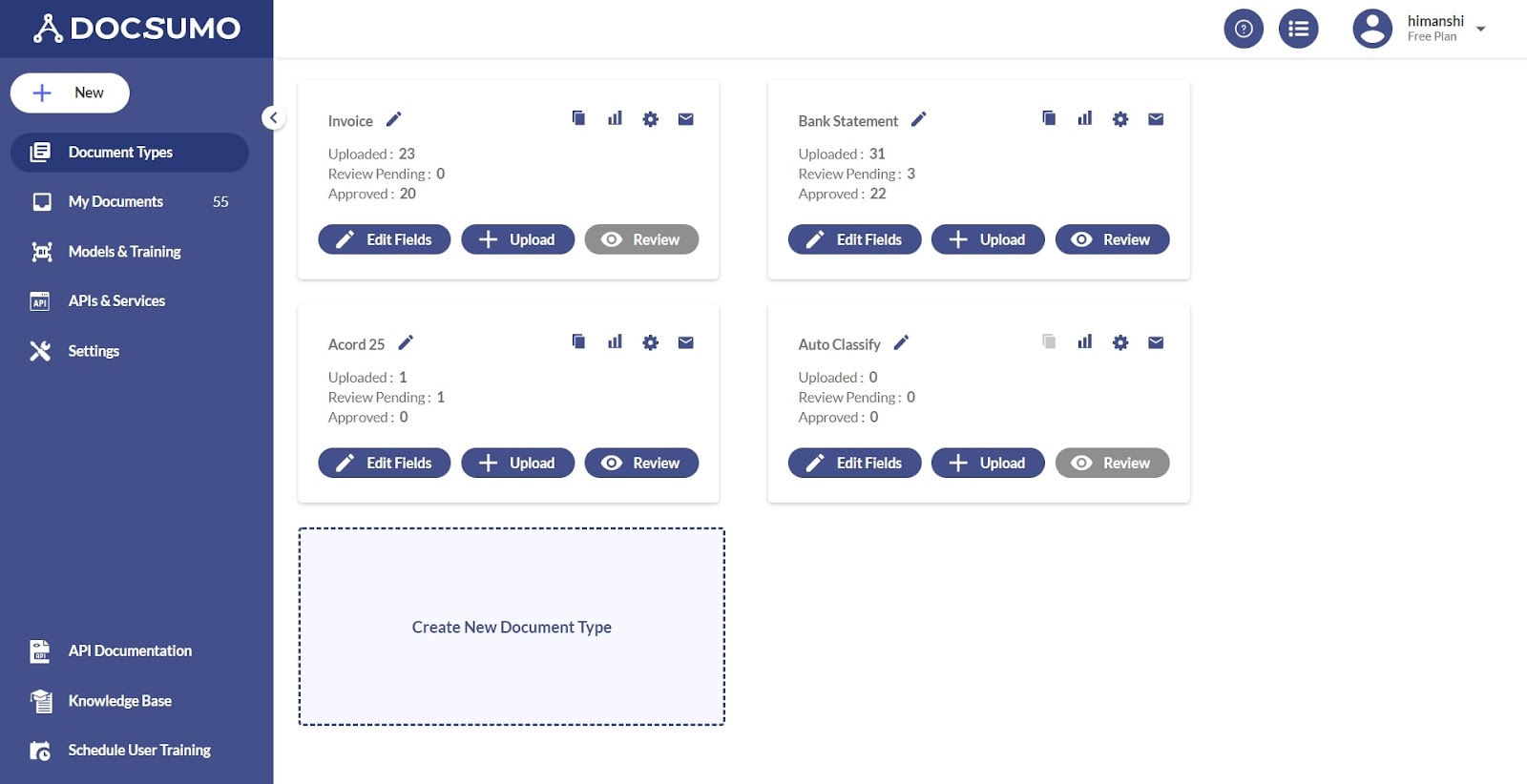

2. Upload Documents

After signing up, go to document types to see different documents, such as invoices, bank statements, and balance sheets. Select ‘Bank Statement’ and click “Upload”. You can either upload from your mail or your local computer.

Remember: Upload unencrypted PDFs to extract data seamlessly.

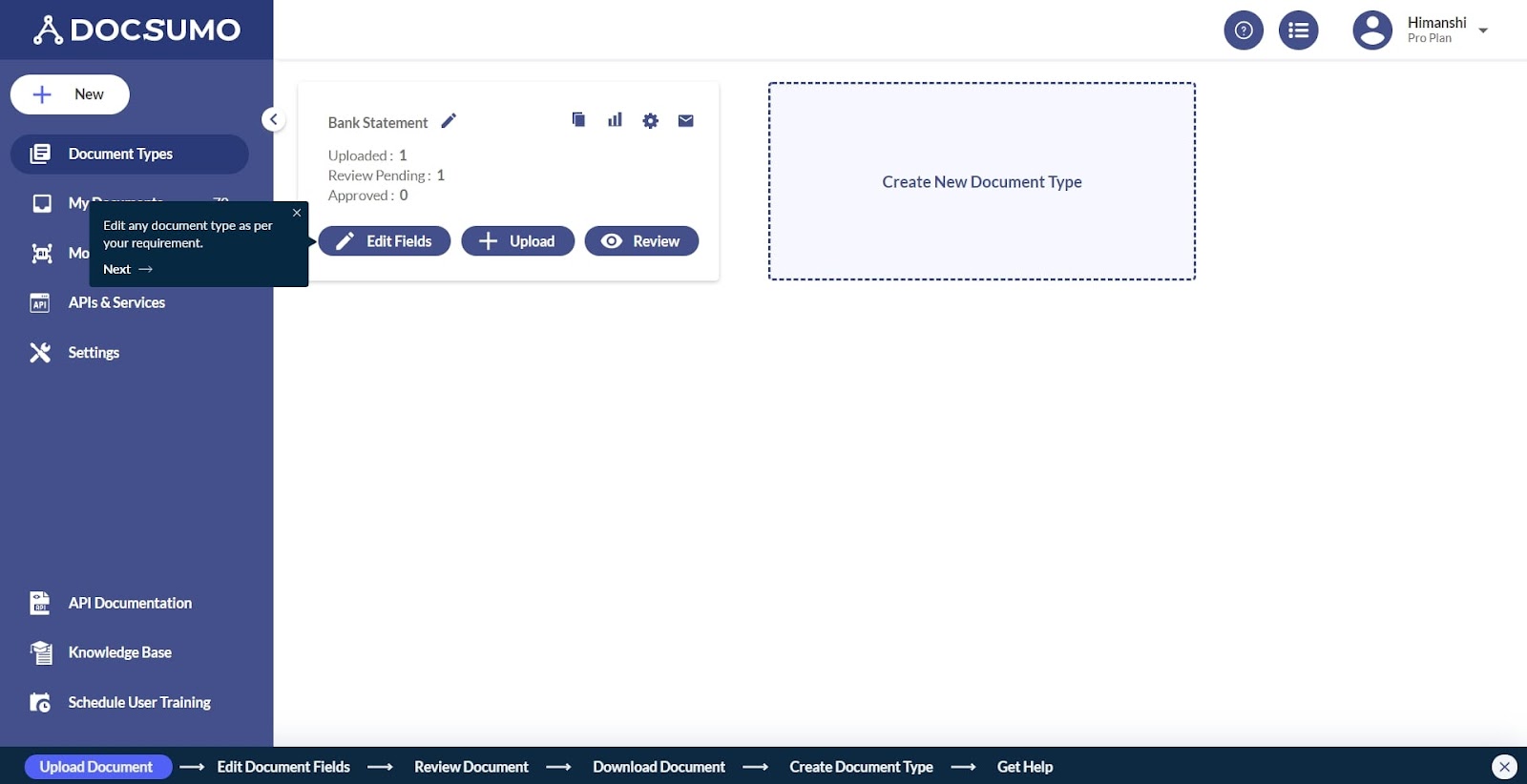

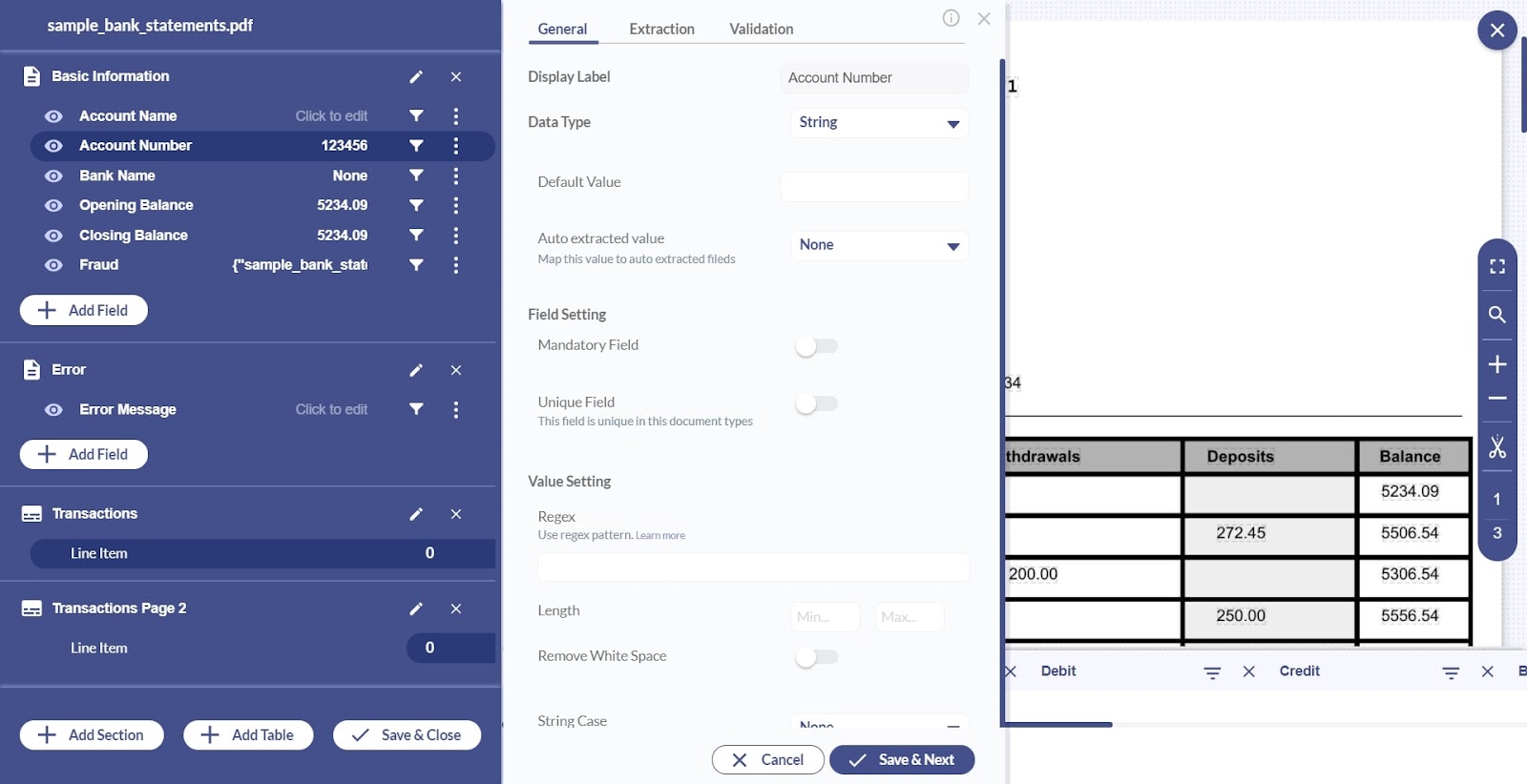

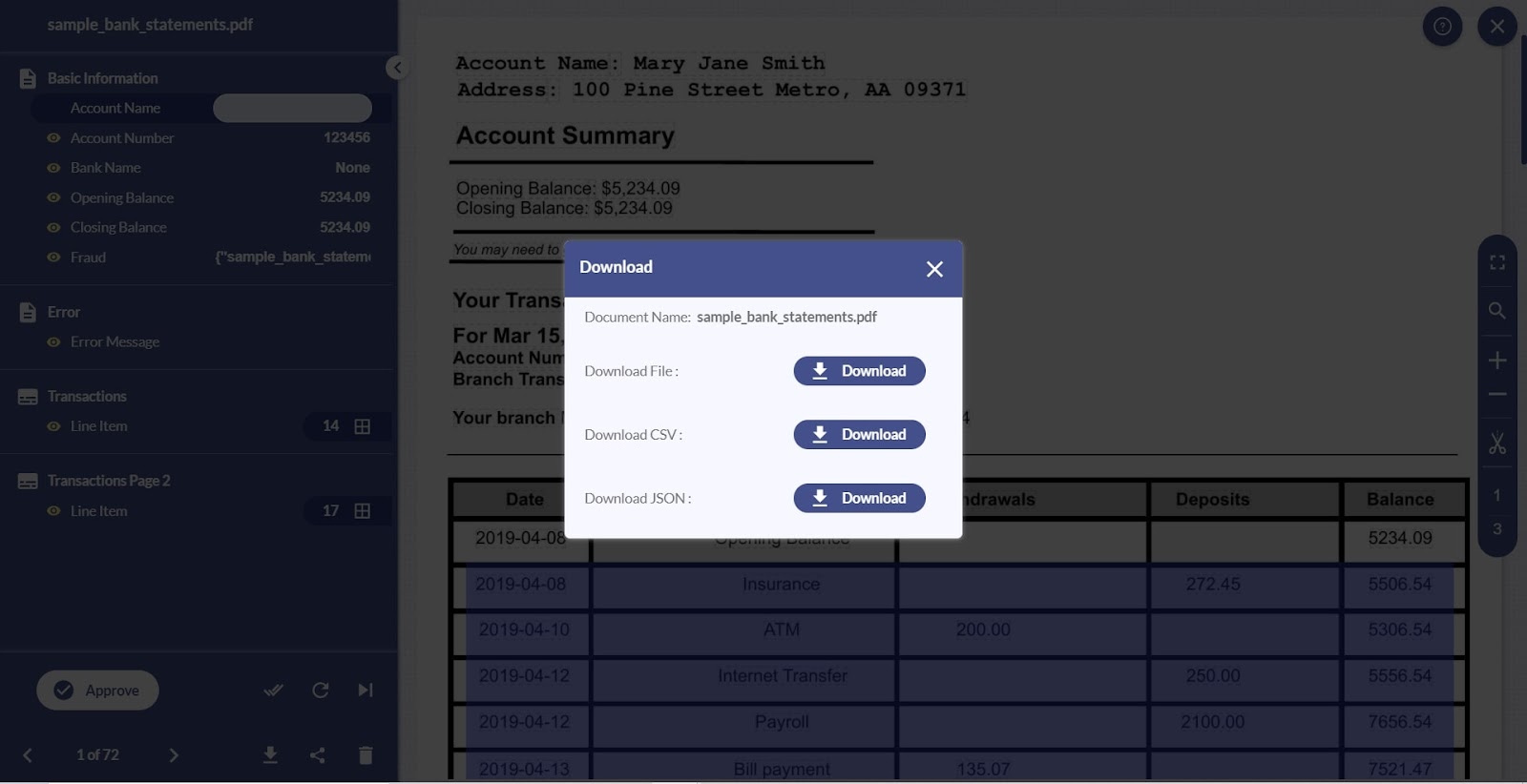

3. Edit the Entries

Docsumo starts processing the bank statements automatically after you upload them.

Preprocessing

Preprocessing cleans the document to enhance the data present in it. Docsumo completes preprocessing automatically using deskewing, denoising, binarization, and zoning.

Data extraction

Docsumo's pre-trained API models will extract key-value pairs from the bank statements. A key-value pair is a set of two data items: a key and a value. Multiple key-value pairs extracted provide the crucial information from the bank statements.

For example, for bank statements, the ‘Opening Balance’ would be the key field with the value denoting ‘$1000’. Similarly, Docsumo would extract multiple key-value pairs from the bank statements, such as

- Account holder name

- Account holder address

- Account number

- Account type

- Opening balance

- Closing balance

- Transaction date

You can edit these fields according to the data you need for your business operations. Add or remove entries and customize the API model to how you want to extract from upcoming bank statements.

4. Validate Fields

After extraction, the data undergoes automatic validation and then is set ready for final review. Docsumo finds inconsistencies and errors in the data extracted during validation to ensure accuracy.

5. Review Suggestions

Once validated, you can review and validate each data manually. Review the data manually before you start processing documents at scale to train the model to yield over 99% accuracy.

In case of errors, review and update the particular field. Finally, click “Approve” to save the data.

6. Download the Excel document

You'll see an option to download the data below. Click "Download" and choose "Excel/CSV" to access the data in Excel format.

7. Integrate data

Integrate the extracted data into accounting software like QuickBooks, Xero, Chargebee, and other business applications your organization uses for streamlined workflow and fewer errors.

8. Scale multiple document processing

Upload multiple bank statements and extract data from all of them simultaneously. Automate the data extraction and validation process and employ humans for final review.

This way, you can automate repetitive tasks (data extraction) and let employees focus on strategy-driven tasks.

Some of the benefits of automating bank statement extraction using Docsumo are:

- Increase efficiency by 10X

- Reduce operational costs by 60-70%

- Process documents in 30-60 seconds

- Over 99% data accuracy

- Compliance and security measures such as GDPR and SOC-2

- Integrates with existing ERP, CRM, and other applications

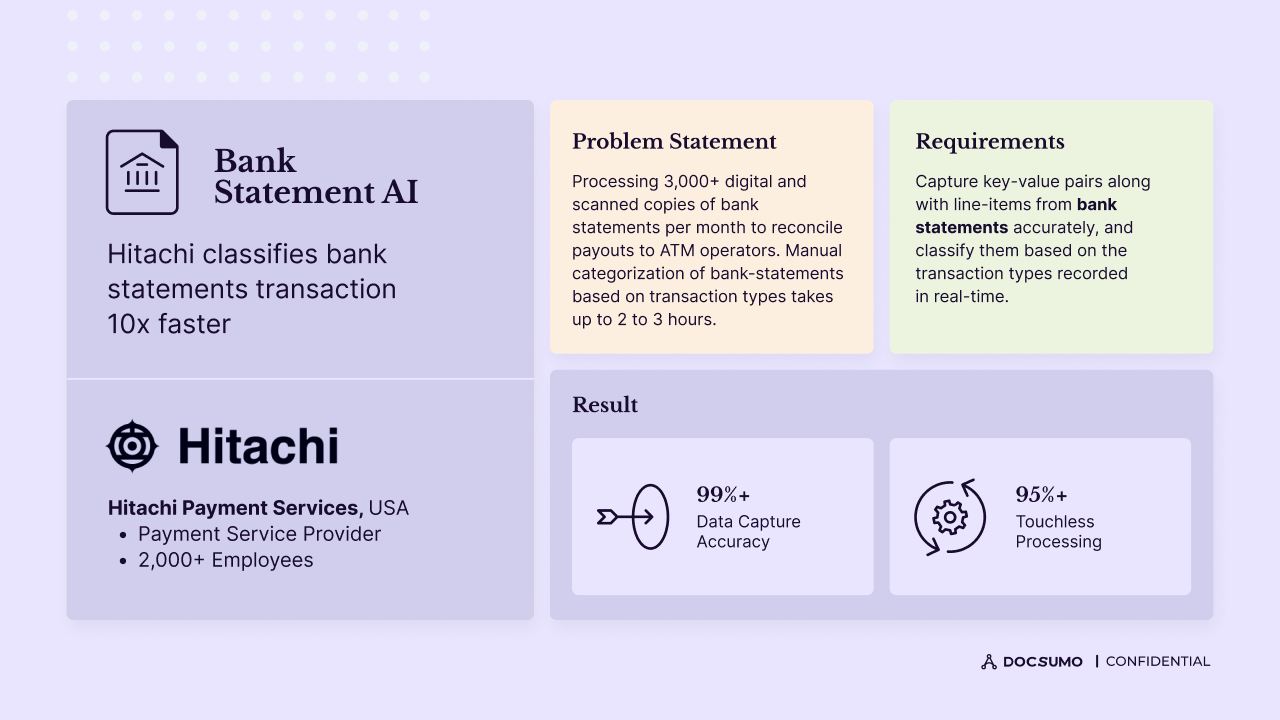

Still trying to decide if your business should automate the data extraction from bank statements? Here's how Docsumo helps Hitachi (a white-label ATM provider) streamline bank statement reconciliation.

Practices for managing and storing your converted Excel/CSV bank statements

Some practical tips to help you manage your Excel files safely include:

a. Data security

Any business dealing with financial data should adhere to national and international regulations, as leakage of sensitive financial information may invite penalty charges. IBM's data breach report shows that the average data breach cost was $4.45M in 2023.

Apart from financial losses, companies lose their trust, reputation, and potential business opportunities. Data breaches can devastate a business, and you need stringent security protocols to prevent such losses.

The security measures that Excel offers to protect your financial data are:

Encryption

Varonis' 2021 financial data risk report shows that over 64% of financial services companies have over 1000+ sensitive files open to every employee. This implies that businesses should ensure encryption if the file contains sensitive financial data. Excel's file encryption option allows you to lock a file so that no one can access the file except you.

Password protection

The same Varonis report shows that every financial services employee can access more than 11 million data files. To avoid this, protect your Excel files with strong passwords and share them only with team members based on their role's requirement to use the file. This way, only users with passwords can access the file to view, edit, or modify.

Mark as final

This option allows you to mark the particular file as the final version so that users can never edit or modify the data.

Backup data

Follow the simple 3-2-1 backup strategy; have 3 copies of your data on 2 different media with one for off-site recovery.

b. Data management

The two best tips to help you locate the Excel files immediately are:

Naming files

Maintain consistency in your file naming pattern throughout the Excel files. Use abbreviations and the client's name in possible files to locate the file by searching in a second.

Create folders

Create a folder to manage the client's multiple data files in a single place. Repeat the same for your multiple clients and access the data without much stress.

The benefits of converting PDF bank statements to Excel/CSV

Converting bank statements to Excel helps analyze data, develop financial models, and reduce expenses. However, relying solely on a manual process or using fragmented tools as a piecemeal solution to convert data increases time, costs, and errors.

With Docsumo, convert data from scanned/PDF bank statements with 99% accuracy. Employ humans only to validate the final data. Moreover, it takes only 30-60 seconds for Docsumo to extract data, allowing you to make decisions quickly.

The result? Increase efficiency by 10X and reduce operational costs for your business by 60-70%. Docsumo's integrations help data flow in real time between different business sources without manual input.

Sign up on Docsumo and start extracting data with 100% automation.

FAQs

1. How secure is converting bank statements to Excel?

Security and compliance with converting bank statements to Excel varies according to the AI document software. Invest in an automation tool that follows national and international regulations such as GDPR and SOC-2 to avoid penalty charges.

2. Can I convert a scanned paper bank statement to Excel?

Yes, automation tools convert digital and scanned bank statements to Excel format.

3. What are the benefits of converting PDF bank statements to Excel format?

Converting data from bank statements to Excel allows businesses to track income and expenses, create budgets, identify trends and patterns, and make informed decisions.

4. How to convert PDF bank statements to Excel format?

Ingest the documents onto the Docsumo platform, and it extracts data. After extraction, validate each data, approve and download the data in Excel format.

5. Which is better to convert PDF bank statements to Excel? Manual or Automated conversion?

The manual process is time-consuming and error-prone, resulting in decreased efficiency. Meanwhile, automating conversion saves time, reduces costs by 60-70%, and increases accuracy to 99%.

.svg)

.svg)

.webp)

.webp)