Suggested

An in-depth Guide to Automated Invoice Scanning Software

Automated Invoice Processing, a key back-office task that can lead to a great deal of time & cost savings if automated correctly.

For business trying to adopt automated data extraction solution for invoice processing in their system, the question of cost vs benefits of an automated solution tops the list. For smaller businesses that process a few hundred invoices a month, automation may be a far fetched idea but for businesses processing thousands of invoices in a month, automation is the preferred mode of processing invoices. In this article, we discuss what are missing out on if you're still processing invoices manually and how can change it with an automated accounts payable solution.

The process of receiving a supplier invoice, matching it against the purchase order, and entering its data into an ERP system or general ledger is Invoice Processing.

It starts when your business makes a purchase resulting in the creation of an invoice and ends when the invoice is paid and its details are recorded in your ledger. The Accounts Payable team can process invoices in 2 ways- manual and automated.

Let's have a look at both of them, one by one:-

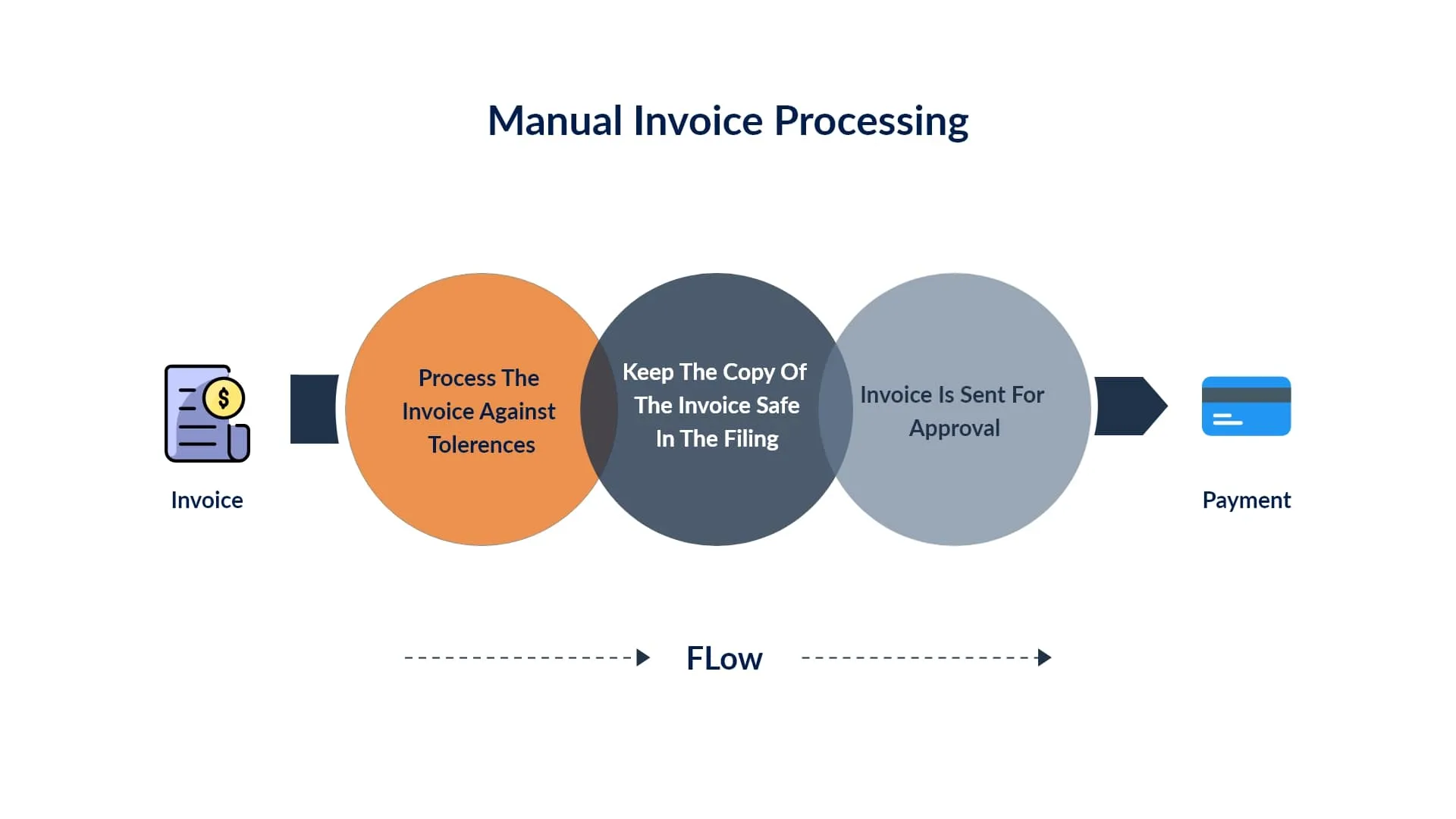

As per the image above, manual invoicing is a multi-step process that requires considerable man-hours and processing costs. As per a report by Sterling Commerce, the cost of invoice processing through the manual mode ranges between USD 12 and USD 30 per invoice while for some firms it can also go up to USD 40 per invoice.

Some of the primary costs incurred in manual invoice processing include the following:-

The primary cost involved in manual data entry is the labor cost of manually recording and checking the invoices. The company has to employ individuals to go through the invoices, check them, and record to complete the invoicing process.

In manual invoice processing, another major cost is the cost of physical paper on which the invoice is created. A large quantity of paper is used for recording invoices, and this involves a considerable cost.

If the cost of paper is not enough, there is the storage cost too which is incurred in storing all the physical invoices.

The invoices should also be checked to ensure that there are no errors. This requires auditing, and auditing involves additional expense.

Lastly, you cannot ignore the opportunity cost involved with manual processing. The time and effort involved in invoice processing incur a considerable opportunity cost as the same time and effort could have been directed to more productive avenues that would have boosted the revenue of the business.

These costs, multiplied by the huge number of invoices generated by a business in a month result in a considerable business expense.

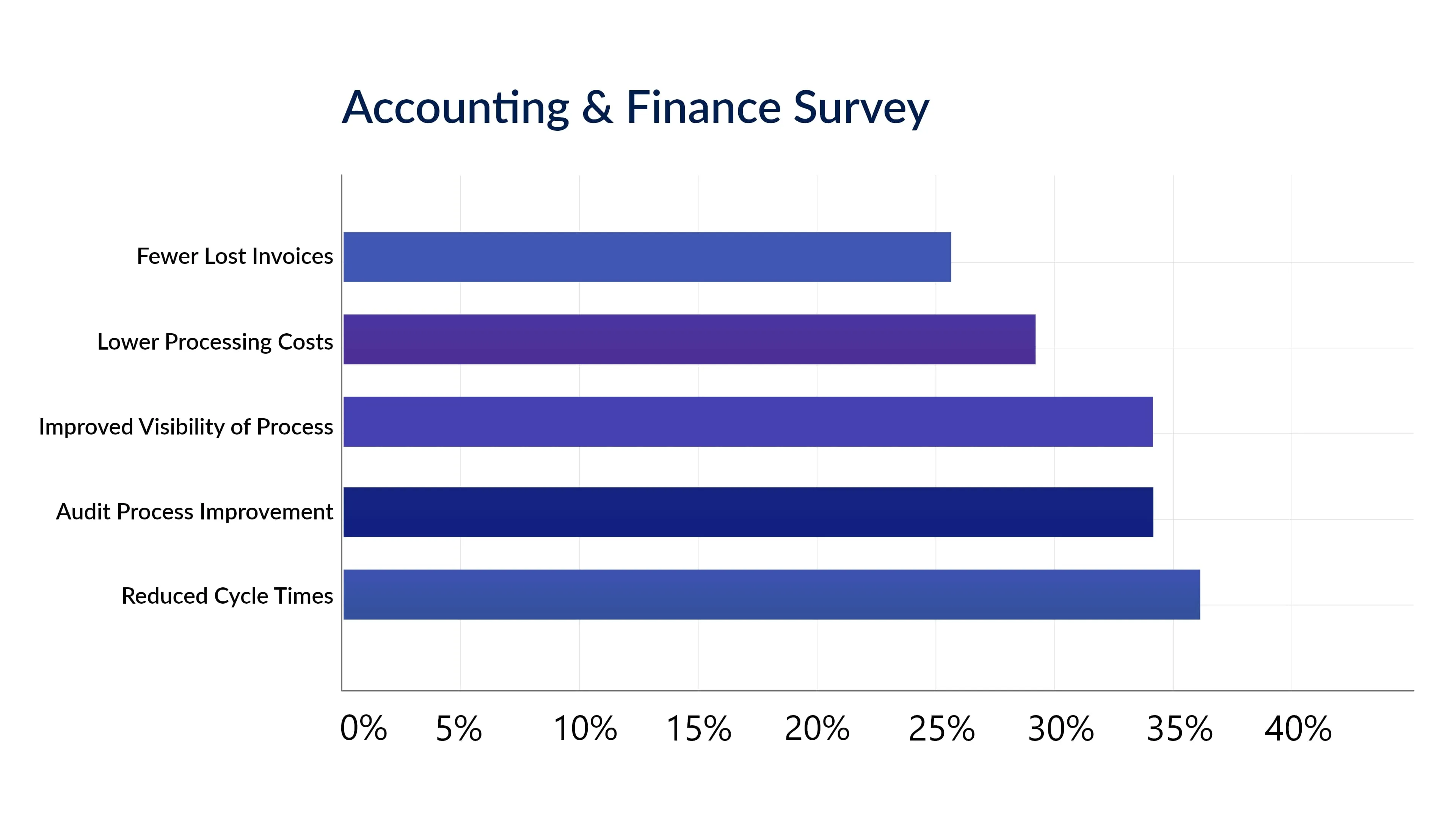

Automated invoice processing is the best way to reduce the average cost to process an invoice and also to make the invoicing system effective. In a survey conducted by Paystream Advisors among accounting and finance professionals, the following main benefits of automated invoicing were recorded:-

Besides these commonly identified benefits, there are other hidden advantages of automated invoicing as well. Let’s have a look -

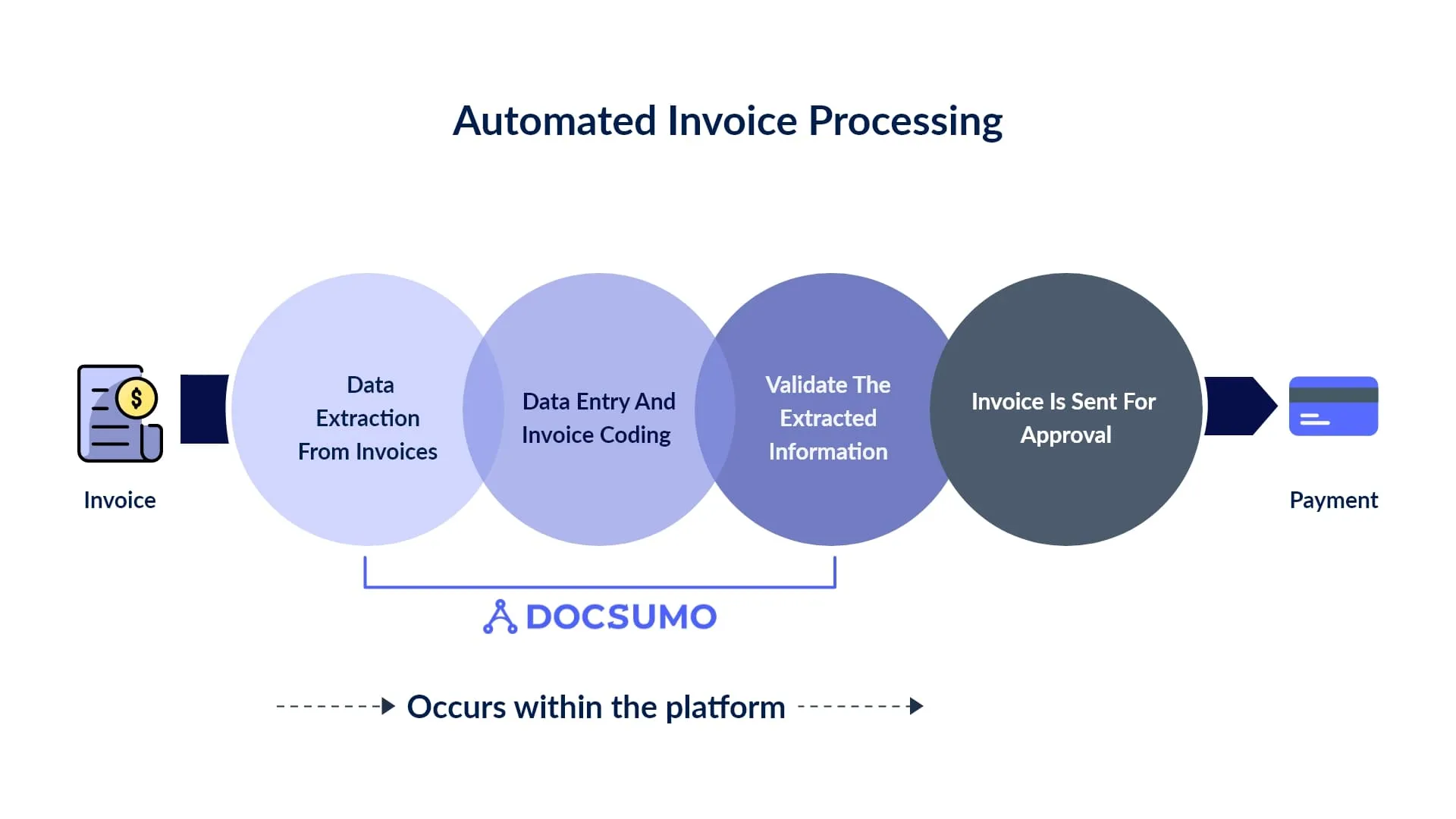

As the survey indicates, the main advantage of an automated invoice processing system is the reduced processing time. Against the manual mode, the automated mode involves fewer invoice processing steps, which saves time. Have a look:-

From a 5-step process to a 3-step one, automated invoicing definitely saves time.

Automated invoicing also cuts down the cost of invoice processing. Through automation, the cost to process a single invoice comes down to as low as USD 1.

As the costs reduce exponentially, the business can cut its operating costs to improve its profitability. Moreover, as the invoicing is captured timely, the possibility of a late fee on payments reduces.

It becomes easier for you to track invoices through the automated invoicing system regardless of the number of invoices generated. You can easily check your invoices for any discrepancies, and wrong entries, and take the corrective measures required for correct invoicing.

Auditing your business and ensuring that it follows the compliance norms become easier with automated invoicing. Automation makes it easier for your business and the auditor to track invoices and match them against purchase history. Moreover, through automation, the risk of lost or missing invoices, misfiled invoices, and human error reduces significantly.

When invoicing is automated, the probability of lost invoices, manual error in accounting the invoice amount, and misfiling of invoices decreases. After all, it is human to err. However, machines do not err and automation removes these possible pitfalls of manual invoicing and makes the whole process smoother and accurate.

As manual invoicing takes time, many invoices remain unaccounted for resulting in payment delay. By switching to automated invoicing, your business can make timely or even early payment to suppliers. This helps your business in two ways.

i) You can avail of a discount on earlier payments.

ii) Your relation with the supplier improves as the supplier deems you to clear your payments on time, every time.

Businesses can achieve increased profitability through automation by combining two benefits of automated invoicing.

i) The first benefit is the reduced cost of invoice processing

ii) The second benefit is the availability of supplier discounts on early payments.

Both these benefits mean one thing - reduced expenses as business expenses reduce, its profitability increases. This profitability, in turn, helps the business to create more reserves and grow.

Automation helps you capture invoices digitally and upload them on a cloud that anyone can access easily from anywhere. This is particularly helpful if your business has offshore bank accounts that need to access the invoices in real-time whenever needed.

Automated invoicing software is flexible and can be customized as per your business’s invoicing needs. You can create a personalized accounts payable flowchart and route the invoices in a particular order. You can also authorize multiple access to your accounts department’s different employees, who can access the invoices when needed during drafting, auditing or payments.

Businesses often face the risk of fraud through spurious or fake invoices designed to manipulate profitability. In fact, established companies like Google and Facebook suffered frauds of more than USD 100 million over a period of two years by making payments for fraudulent invoices. To save your business from this scenario, automation is the key. Through invoice automation, the chances of frauds reduce. When the invoices are recorded automatedly, they are also verified and cross-checked against purchases. Moreover, a centralized database of invoices is created, which leaves little to no room for fake invoices or frauds.

In a 2020 research conducted by Ardent Partners, only 31% of the businesses were found to have automated their invoicing systems while 28% were engaged in moderate automation. 40% of the businesses, on the other hand, had no automation in place. Businesses, therefore, have a long way to go to unlock their potential fully.

Automation is the innovation that is on the rise in business accounting, and your business needs to keep pace with the changing times. Switch to automated invoice processing to not only save on the cost of invoice processing but also to make your business more profitable.

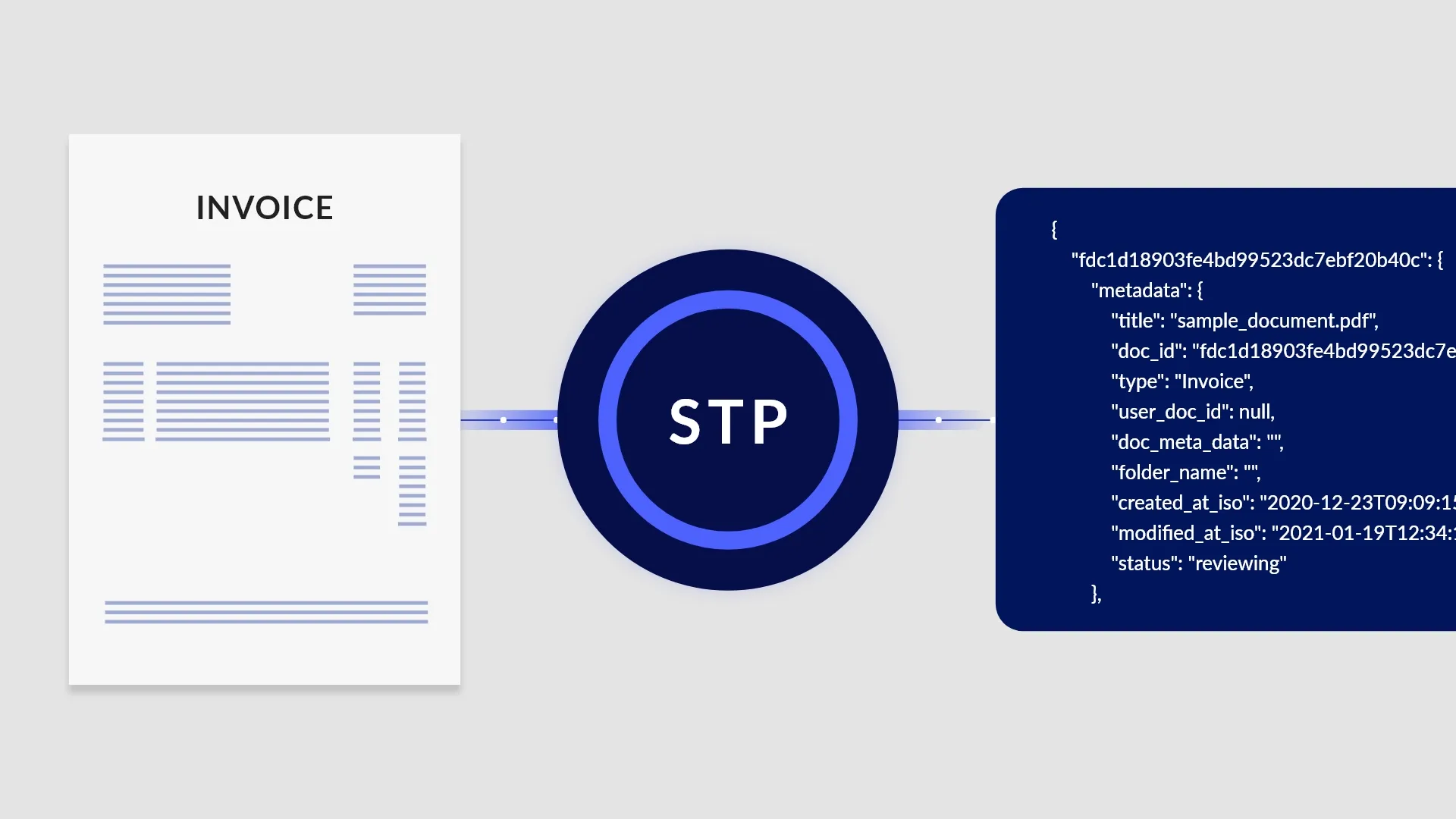

Docsumo is a technology driven platform which provides you the solution to automate your invoice processing. With Docsumo’s digital accounts payable solutions your business can process its invoices within seconds and that too with 99% accuracy. Docsumo uses the OCR technology to digitize your invoicing process thereby eliminating the chances of errors and reducing the processing costs. Talk to us today, to automate your invoice processing workflow!