8 Best COI Tracking Software: Simplify Certificate of Insurance Management

COI tracking software is here to save the day, streamlining everything from data entry to policy expiry alerts. Read on for a deep dive into everything you need to know about COI software and our top 10 recommendations.

A COI is an indispensable document in the insurance business. It lists an insurance policy’s details and serves as proof of coverage for the policyholder. Yet, dealing with a mountain of hard copies of COIs can prove daunting.

This can be easily avoided when you have COI-tracking software in your operational arsenal. It digitizes and streamlines the COI management process, i.e., no more data entry hassles, missed renewals, or unclear compliance.

So, here is a list of the top 10 COI tracking software solutions, along with their benefits, key features, and pricing structures, to help you find the right COI software for your business.

What is a COI Tracking Software?

A COI tracking software is designed to help insurers streamline the collection, storage, and management of COIs. Besides the collection and secure storage of electronic COIs, this digital tool helps track expiration dates and send out alerts when a COI is nearing renewal, extract key information from uploaded certificates, and get a clear picture of your compliance status via dashboards and reports.

How COI software simplifies certificate management

- Digital onboarding: Contractors and vendors upload their COI documents to the software instead of mailing hard copies.

- Centralized storage: All uploaded COIs are securely stored in the cloud, allowing users to access them no matter where they are or what time it is

- Automatic alerts: The software tracks certificate expiration dates and sends automated notifications as a COI nears its expiration date, thus preventing any gaps in coverage

- Compliance monitoring: The software provides you with a clear picture of your compliance status and helps identify COIs that are valid, need renewal, or have expired

Features and benefits of using COI tracking software

While picking a COI solution for your company, it's imperative to factor in the following key elements:

- Automated alerts for COIs notify relevant stakeholders when a COI is approaching its expiration date to facilitate prompt action

- Customizable reporting capabilities help meet unique business requirements, including specific coverage types

- Integration with existing systems, such as vendor/supplier databases, improves efficiency, data accuracy, and accessibility

- Document management in a centralized digital vault wipes out the need for physical paperwork and makes document retrieval easier

A Guide to Choosing the Best COI Tracking Software

Here are some functionalities and features that will determine how effective the software is for your business.

a. Automated COI renewal reminders and alerts

Look for solutions that allow vendors and contractors to upload their COIs to the system for quicker processing. The product must be able to track expiry dates and send timely alerts, thus helping avoid potential compliance issues.

b. Integration with insurance providers and third-party systems

Software that can be integrated with existing systems, such as accounting software, CRM, contract and vendor management systems, etc., eliminates the need for manual entry and improves data accuracy.

c. Customizable COI compliance checks and notifications

Customized compliance checks prevent non-compliance liabilities by verifying and analyzing documents for validity, limits, and discrepancies. Customization capabilities must also cover notifications to stakeholders for various actions, such as approval, verification, expiration, etc.

d. Reporting and analytics capabilities

Comprehensive reporting features monitor the business' compliance status, identify patterns, and help track key metrics. Reports tailored for specific needs help reach business decisions quickly without investing time and effort in gathering data from disparate sources.

e. User interface and ease of use for stakeholders

The easier and more intuitive the software, the better. A clean, simple-to-use interface encourages quicker adoption and helps stakeholders use the software effectively

10 Top COI Tracking Software in 2024

1. Docsumo

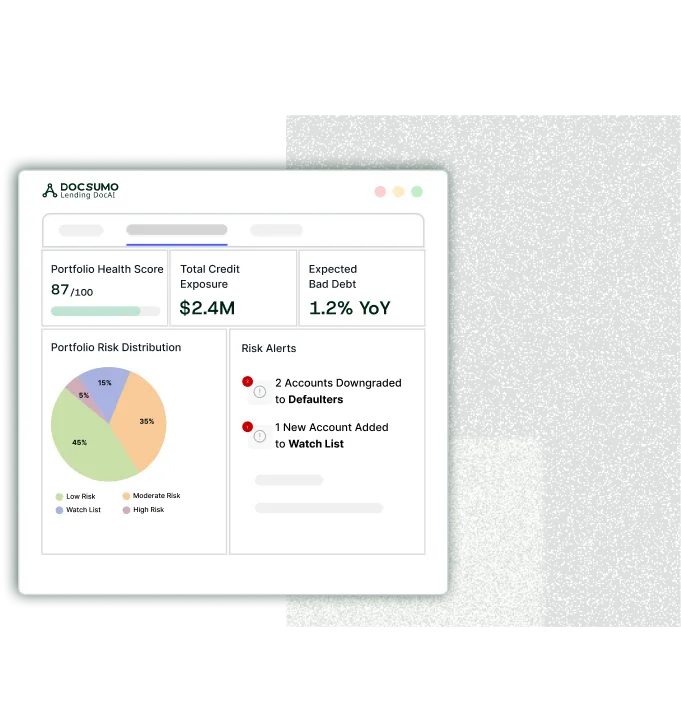

Docsumo is a cloud-based document processing platform that extracts data from various documents, including COIs. It automates processes such as document classification and data extraction from any document with more than 90% accuracy.

The platform offers real-time compliance monitoring, automated alerts, and reliable, round-the-clock customer service. Companies can use the platform’s customization abilities to ensure accurate and efficient data extraction for unique document types.

Key features

- Use ready-to-use AI models to extract key data points from uploaded COIs automatically

- Get a clear view of your compliance status with robust reporting and intuitive dashboards

- Stay up-to-date with renewals using automated and customizable alerts for expiring COIs

- Integrate with various industry-specific systems like vendor and contractor management systems

Limitations

- Lacks features to create new documents from scratch

Pricing

- Growth: $500/month

- Business: Custom pricing

- Enterprise: Custom pricing

Reviews

- Capterra: 4.6/5

- G2: 4.7/5

2. InsureCert

InsureCert is a no-code insurance platform that offers features for managing COIs, policy issuance, and other insurance workflows. The platform also offers high levels of scalability to accommodate growing insurance agencies.

Using an agile approach, the platform helps integrate customized insurance solutions into existing workflows.

Key features

- Has advanced features and integrations to manage the complete policy lifecycle

- Offers an extensible reporting model that can be customized according to business models

Limitations

- Configuration and user training can be time-consuming

Pricing

- Custom pricing

Reviews

- Capterra: 5/5

3. SmartCompliance

SmartCompliance offers insurance tracking and compliance management solutions to help insurance professionals streamline the process of tracking and collecting COIs.

Its solutions, available as self-service or full-service, automate renewals of insurance certificates or proofs, eliminate manual data entry, and help ensure compliance from start to end.

Key features

- Enables complete COI management from a centralized location

- Offers easy search and filter options for quicker audits and claim processing

Limitations

- Notices issued to subs are challenging for them to follow and understand the deficiencies

- The UI is clean but not always user-friendly or modern in its appearance

Pricing

- Custom pricing

Reviews

- G2: 4/5

- Capterra: 4.5/5

4. eBaoTech

eBaoTech, a leading name in insurance technology, offers two core solutions: InsureMO, an insurance industry middleware, and eBaoCloud, a collection of apps for insurers, brokers, MGAs, etc.

Built to deliver the 3Vs—Variation, Volume, Velocity—the InsureMO brings vendors, brokers, and companies together on a safe and efficient platform to offer a comprehensive suite of services.

Key features

- Facilitates digitization of renew and claim lifecycles

- Has a cloud-native architecture that optimizes operational speed and performance

Pricing

- Custom pricing

5. CertFocus

A certificate of insurance tracking and management services provider, CertFocus provides multi-tiered service offerings, from self-service to fully automated review and processing. It provides full reporting and integration into accounting systems, etc., leading to significant time and cost savings.

CertFocus helps companies design and develop customized platforms to ensure COI compliance from vendors, suppliers, and subcontractors.

Key features

- Automates processes to eliminate the costs associated with processing, reviewing, updating, and maintaining COIs

- Leverages cloud-based architecture to provide unlimited data storage and robust data protection

Pricing

- Custom pricing

6. COI Tracker

COI tracker is a 100% cloud-based, full-service COI tracking solution that assures a fuss-free COI collection process and an equally adept COI review and validation process.

The system can be securely integrated with ERP or financial systems to maintain data integrity and accuracy across systems. It also helps generate standard and custom reports to inform all stakeholders of compliance status and potential risks.

Key features

- Encrypts and safeguards data through all stages of collection and storage

- Extracts data from COIs using OCR technology to ensure all business requirements are met

Pricing

- Custom pricing

7. myCOI

myCOI is a cloud-based certificate of insurance software that combines industry expertise and customer service to automate COI tracking and reduce the clients' liability exposure.

It can be easily integrated with other platforms and company systems to provide real-time insurance information. Besides advanced compliance management features and automated alerts, it provides insurance expertise through advice from qualified consultants.

Key features

- Send notifications to agents on behalf of insureds for policy updates and renewals

- Manage COIs and other associated documents like invoices, tax forms, and safety certifications in a centralized Document Hub

Limitations

- Does not have a standard naming protocol for the insurance information stored in their system

- The customization of insurance requirements is a bit lacking and could use an update.

Pricing

- Custom pricing

Reviews

- G2: 4.7/5

- Capterra: 4.8/5

8. CertVault

CertVault is a cloud-based COI repository and delivery system that makes certificates immediately accessible. It verifies all deliveries as received in real-time by the system and uses blockchain to maintain the integrity of COIs.

Key features

- Offers real-time certificate monitoring to reduce risk exposure

- Extracts data from COIs using robotic data extraction and stores it securely using blockchain technologies

Pricing

- Custom pricing

How COI Software transforms industries?

Construction companies may have been the early adopters of COI tracking software. However, the advantages of certificate of insurance software extend across the broad spectrum of industries.

a. Construction and contracting

Construction projects involve a complicated network of contractors, vendors, etc. In this case, COI tracking software helps in:

- Keeping an eye on COIs for all contractors involved

- Ensuring contractors have all the required insurance coverage

- Streamlining COI sharing with government agencies and other stakeholders

b. Property management and real estate

Property management teams deal with COIs for tenants and vendors, among others. In this particular context, COI software can help verify:

- Proper insurance coverage for tenants

- Requisite liability coverage of vendors, such as janitorial services or maintenance

c. Event planning and venue management

Event organizers must verify responsible coverage for vendors, be they entertainment providers, caterers, or event planners. COI software helps estate managers:

- Ensure that vendors have coverage specific to the event type

- Verify the performer's liability insurance covers things like potential fire damage, etc.

- Ensure the art transport company's COI includes coverage for the specific value of the loaned pieces

d. Transportation and logistics

Logistics providers, trucking and freight companies, etc., rely on a network of carriers and subcontractors. COI software helps them with:

- Efficiently keeping tabs on COIs for carriers and subcontractors spread across different geographies

- Confirm sufficient cargo insurance coverage for transported goods

How COI Tracking Software transforms your business?

Forget the paper chase. Treading beyond just compliance, COI tracking software is a game-changer for businesses. Here's how you stand to benefit from it:

- Streamlined COI verification and compliance processes: A COI tracking software enables electronic collection and storage, making verification simple. In addition, it improves security and accessibility through a secure, centralized digital location, reducing the amount of time spent manually sorting through COIs, hence streamlining the entire compliance process.

- Reduction in manual tracking errors and delays: Errors when tracking COIs manually could result in coverage gaps or missed renewals. By automating expiration alerts, COI software ensures prompt renewals and avoids compliance issues that could result in financial penalties.

- Improved risk management and contractual compliance: COI software helps track and verify specific coverage types contracts require. This reduces risks and guarantees contractors and vendors have the insurance they need to meet their contractual obligations. Hence, you can proactively address gaps and safeguard your business from unforeseen liabilities with clear visibility of compliance status.

- Enhanced vendor and contractor relationship management: COI tracking software makes it easier to collaborate with contractors and vendors. As a result, you can fortify relationships with your partners, prompting a more secure business environment.

Challenges of COI Tracking Software and How to Overcome Them

Before you implement a COI tracking software, it's important to be aware of some potential challenges:

a. Finding the right solution

With multiple COI software options, making the right choice can feel overwhelming. Research! You must first identify your business needs, such as budget, expected features, etc., and then shortlist solutions accordingly. You should also sign up for free trials and demos to test the solution’s functionality and user experience.

b. Building familiar interfaces for users

It can be challenging to overcome initial resistance when introducing new software. It is advisable to choose software with an intuitive, easy-to-understand user interface. Look for solutions that provide comprehensive training sessions and ongoing support to employees. In-app tutorials can also be helpful.

c. Ensuring regulatory compliance

Because regulatory requirements can vary, it’s important to make sure the software you choose conforms to all compliance requirements. Select a software provider who is familiar with your industry’s regulations. Also, look for solutions with compliant security and data storage features.

d. Data migration

Transferring existing COI data from paper or legacy systems to the new software can feel daunting. Often software providers offer free data migration assistance. Alternatively, consider solutions with built-in tools for data import from various sources.

e. Integration with existing systems

It can be tricky to integrate COI tracking software with your existing business systems. You can remedy this particular challenge by focusing on solutions with open APIs or pre-built integrations for your specific systems. Also, remember to analyze the software's ability to connect and share data efficiently.

How Does Docsumo Fare Amongst All COI Tracking Software?

Unlike other platforms used for COI management, Docsumo integrates OCR with advanced AI technologies to automate data extraction from insurance policies. It can also automate document classification and data extraction from any document, offering over 90% accuracy.

The platform offers customization, real-time compliance monitoring, and automated alerts for policies nearing expiration.

Here’s how your COI management processes stand to benefit from Docsumo:

- Improve operational efficiency by 10X

- Ensure compliance with GDPR, HIPAA, SOC-2

- Integrate with CRMs, ERPs, etc.

- Achieve an accuracy rate of over 99%

With Docsumo, you can immediately start automating document processing using pre-trained API models or train custom API models to suit your specific requirements.

Mitigate Risk and Boost Efficiency with COI Tracking Software

COI software streamlines everything, from vendors uploading COIs digitally to all documents securely stored in the cloud. It also offers several other benefits, including automated alerts about upcoming expirations, insights into your compliance status, etc., to facilitate efficient insurance and compliance management.

These benefits will only get better as technology continues to evolve and new trends emerge in the market. Case in point: artificial intelligence (AI). AI-driven innovations are transforming COI management, streamlining data gathering and analysis endeavors, and leveraging predictive analytics to provide insights into potential compliance challenges.

Plus, with growing concerns regarding data security, the focus on data protection measures is set to grow as well. The COI management and the software that enables it are all poised for significant change in the modern landscape.

When you invest in the right certificate of insurance tracking software, the strategic improvement of business operations outweighs the mere automation of tasks. Remember that the right solution for your business will simplify compliance, give you the ability to manage risk effectively, and boost the efficiency of your operations.

FAQs

1. What is COI tracking?

COI tracking refers to the process of monitoring and managing insurance certificates. This involves verifying coverage, tracking validity, ensuring compliance, and more.

2. How do I generate a certificate of insurance?

You can generate a certificate of insurance by contacting your insurance provider, who will then ask you to provide some standard information, such as the policy number, the name of the insured, etc.

3. What is the use of an insurance certificate?

A COI is used as proof of insurance coverage. It includes key details and conditions of the policy.

.webp)

.webp)

.webp)