OCR in Loan Processing: Simplifying Document Handling for Faster Approvals

Use OCR in loan processing to work more efficiently. Automate key document extraction and validation. This reduces errors and speeds up approvals. Plus, save on costs by cutting manual labor.

According to Wipro, it takes 35 to 40 days for banks, lenders, and other financial institutions to process loan applications. While this process is slow and labor-intensive, it increases business costs significantly.

Often, lenders hire service providers to gather and review data, which adds cost and complexity. Manual document checks slow down the process, increasing costs and inefficiencies. Rising production expenses, such as commissions and staffing, also reduce profits.

Automating the loan process with OCR (Optical Character Recognition) is vital to tackle these issues.

What is OCR in loan processing?

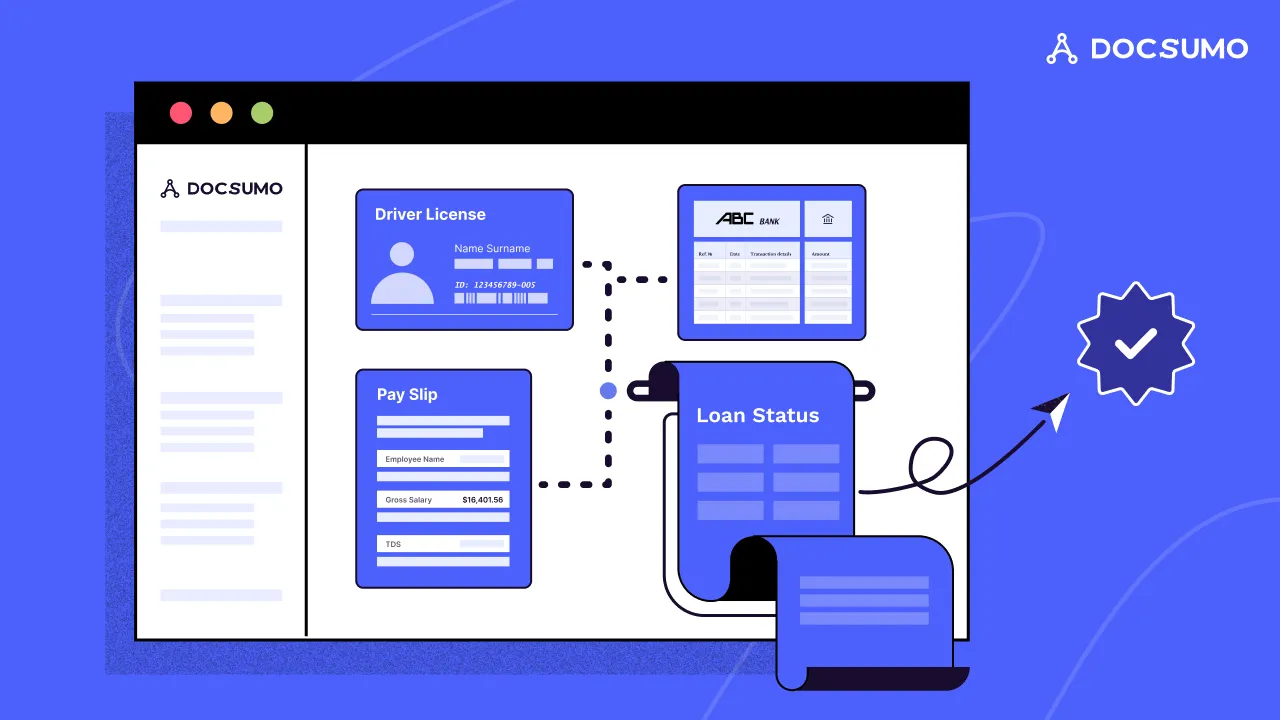

In loan processing, OCR (Optical Character Recognition) lets banks and financial institutions convert their loan documents into editable, digital formats. These documents often include applications, financial statements, and identity proofs.

How OCR transforms loan document management

The process starts when the loan documents, which can be physical or digital, are submitted. OCR technology scans these documents and uses advanced algorithms to digitize their text.

This digitized text is added to the lender's loan processing system, which can be easily searched, accessed, and cross-referenced.

This rapid conversion of text helps:

- Enhance accuracy and reduce human errors

- Speed up the entire loan processing cycle

- Make informed lending decisions

- Improve the overall customer experience

- Lower the risk of non-compliance with financial regulations

The role of OCR in loan processing

Financial institutions are turning to OCR as a strategic solution to improve their loan processes. It streamlines the handling of critical loan documents. These include applications, financial statements, and contracts.

It does this by automating data extraction and speeding up the workflow while ensuring data accuracy. This accuracy is crucial for underwriting, approval, and servicing.

Automates data extraction in loan processing

OCR revolutionizes how loan documents are processed by converting printed or handwritten text from scanned documents into machine-readable formats. This automation is key for processing loan applications and their documents. Here, speed and accuracy are vital.

For instance, when a bank receives a loan application, OCR technology can pull out details about the applicant and their finances from the document. The data is then fed into the bank’s loan processing system. It bypasses slow, error-prone manual data entry work.

Enhances precision in loan underwriting and approval

One of the primary benefits of OCR in loan processing is the data accuracy it provides. Accurate data is crucial for assessing risk and deciding approvals. OCR reduces errors and guarantees the data matches the borrower's documents.

This level of accuracy is crucial in cases that involve many financial documents, where the risk of manual errors can be high and expensive.

Streamlines operations and reduces turnaround times in loan servicing

In loan servicing, OCR technology facilitates a quicker update and retrieval of information, essential for maintaining efficient customer service and operational responsiveness.

When loan records are updated with new payment information, tax documents, or insurance details provided by customers, OCR helps maintain accurate and up-to-date account information.

This capability speeds up service, reduces administrative work, and allows staff to focus more on strategic tasks than just routine data entry.

Benefits of OCR in loan processing

Efficient loan processing is important in finance. It helps keep a competitive edge and ensures customer satisfaction. OCR technology is a tool that changes manual loan processing into automated operations.

Here’s how:

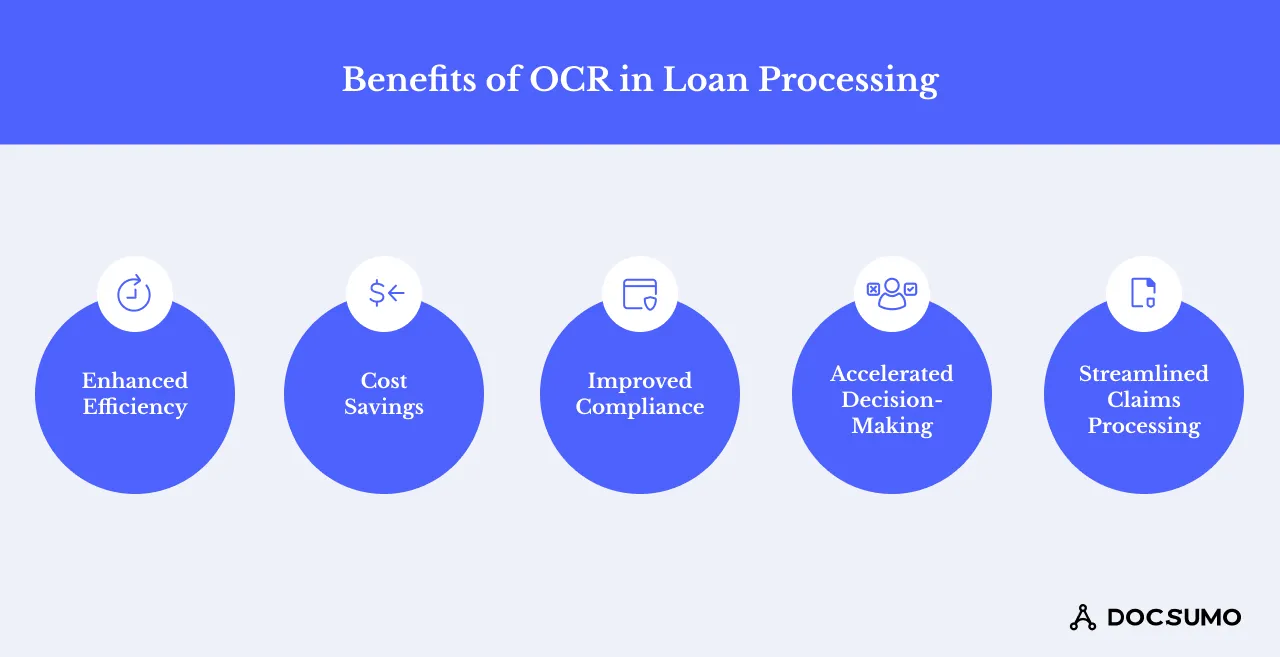

1. Enhances operational efficiency

OCR technology boosts efficiency by automatically extracting data from loan documents. It removes the need for manual entry, which is prone to errors and time-consuming.

2. Reduces cost

The implementation of OCR technology in loan processing leads to substantial cost reductions. Financial institutions can lower labor costs by minimizing the reliance on manual data entry. Additionally, OCR reduces the incidence of errors, which can be expensive to rectify. The combined effect of improved efficiency and reduced errors results in a more cost-effective loan processing operation.

3. Improves compliance and accuracy

Compliance with regulatory standards is crucial in the financial industry. OCR technology increases data extraction accuracy. It also ensures that processed loan document information is precise and reliable.

This accuracy helps meet regulatory requirements and reduces the risk of compliance issues. Furthermore, OCR's ability to maintain detailed records simplifies audits and supports regulatory adherence.

4. Accelerates decision-making

OCR technology facilitates faster decision-making by providing quick access to accurate data. Loan officers and underwriters can review digitized documents quickly, which leads to faster loan approvals. This speed is critical in improving response times to customer applications and customer experience.

5. Streamlines loan processing

Overall, OCR technology streamlines the loan processing workflow. OCR automates and simplifies multiple process stages from initial application to final approval. This streamlined approach allows financial institutions to handle higher loan application volumes efficiently without compromising accuracy or service quality.

Challenges of using OCR in loan processing

OCR technology offers big advantages in streamlining loan processing. But, its implementation has challenges. Financial institutions must navigate various obstacles to maximize the benefits of OCR.

Here are some primary challenges associated with using OCR in loan processing.

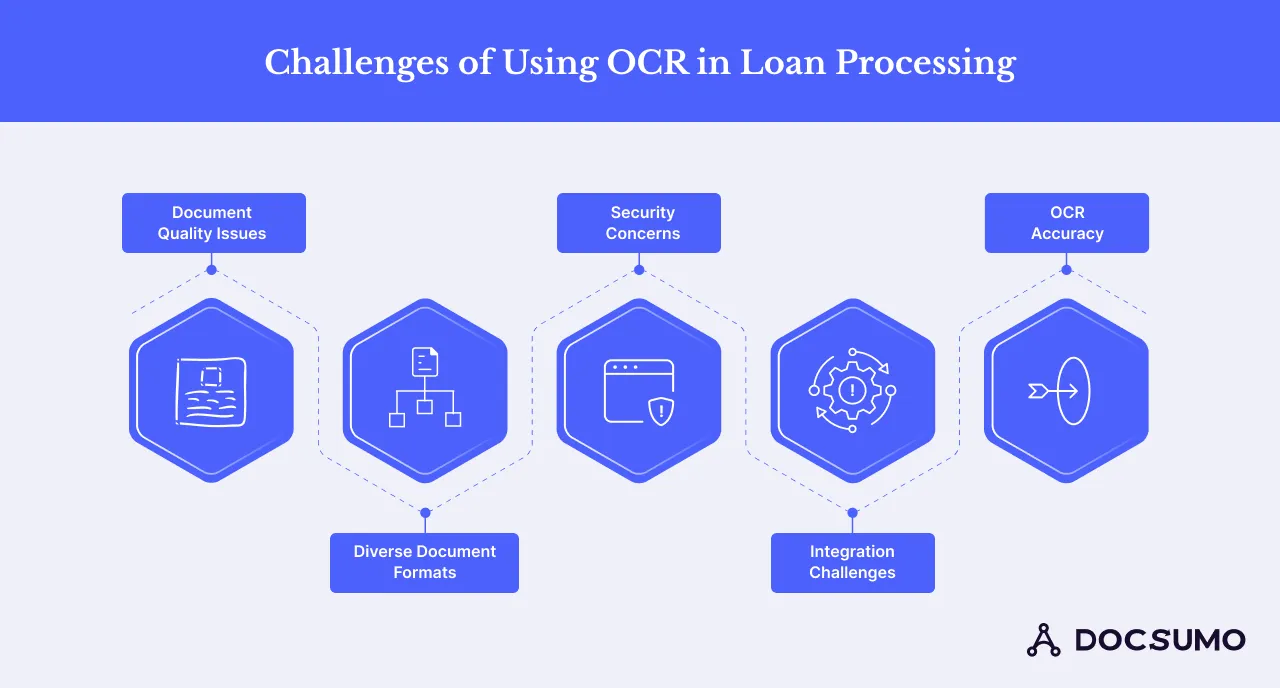

1. Document quality issues

A key challenge in using OCR technology for loan processing is the quality of scanned documents. These systems need clear, high-resolution images to extract data accurately.

Low-quality scans with low resolution, smudges, or faded text, cause data extraction errors. Financial institutions handle documents of different qualities. So, ensuring high-quality, consistent scans is vital for effective OCR technology.

2. Multiple document formats

Loan processing involves various document formats: handwritten, printed, and digital. This mix challenges OCR systems. OCR struggles with handwritten documents due to varied styles. Different fonts, layouts, and designs make accurate data extraction difficult. Solving this requires advanced OCR and ongoing training.

3. Security concerns

The use of OCR technology in loan processing also raises security concerns. Financial documents have sensitive information. It must be protected from unauthorized access and breaches. Implementing OCR systems requires strong security.

It ensures that data is captured, processed, and stored securely. This includes encryption, secure data protocols, and strict access controls to prevent leaks. They also ensure compliance with data laws.

4. Integration challenges

Combining OCR technology with loan processing systems is difficult. Financial institutions use many platforms and old systems, so integrating OCR smoothly requires technical expertise.

The process must ensure data flows smoothly between OCR applications and other systems, including document management and loan origination platforms. The flow must not disrupt existing workflows.

5. OCR accuracy

OCR technology faces a key challenge: achieving accurate data extraction. Despite significant improvements, OCR systems are not perfect. Errors often stem from poor document quality, complex layouts, and clearer handwriting.

Such inaccuracies can lead to wrong data in loan processing, causing incorrect loan decisions. Regular system training and updates are vital to boost accuracy and reduce errors.

Use cases for OCR in loan processing

OCR technology improves loan processing by boosting efficiency, accuracy, and compliance. It covers document verification, automated data entry, compliance checks, and loan management. This technology streamlines processes and helps financial firms work better in competitive markets.

While there are many use cases, here are a few that are worth noting:

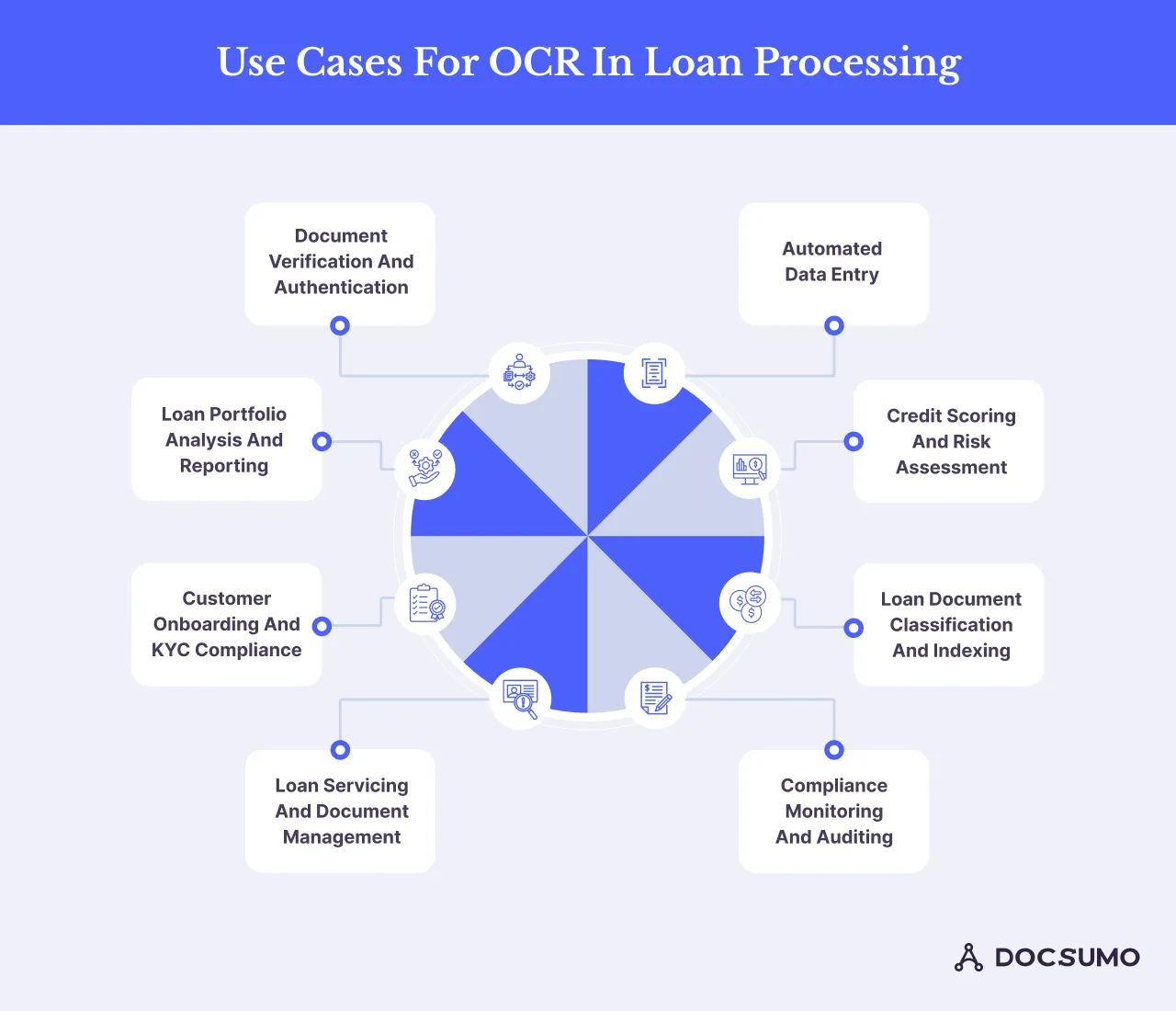

1. Document verification and authentication

OCR authenticates loan documents. It does this by extracting and comparing data from submitted documents. These documents include identification proofs, income statements, and credit reports.

It ensures the accuracy and legitimacy of the information provided by the applicants, reducing the risk of fraud. It also speeds up verification, allowing it to be faster, which enables quicker loan approvals.

2. Automated data entry

Typing data manually is slow and prone to errors. OCR technology extracts data from loan documents, such as applications and contracts, and converts it into text machines can read. This automation speeds up data entry, lowers error risks, and lets staff tackle more important tasks.

3. Credit scoring and risk assessment

OCR technology streamlines financial data extraction for credit scores and risk assessments. It digitizes and analyzes applicants' financial documents. This process quickly reveals their income, debts, and payment histories. Lenders then use this data to decide on creditworthiness and risk. In turn, they can make better lending decisions.

4. Loan document classification and indexing

OCR simplifies the classification and indexing of loan documents. It can sort documents based on content. For example, it can separate loan applications from supporting documents, like tax returns and pay stubs. This automated classification improves how documents are organized and found. It makes loan processing faster by cutting time spent on document management.

5. Compliance monitoring and auditing

Ensuring compliance with regulatory requirements is a significant challenge in loan processing. OCR technology helps financial institutions maintain compliance. It does this by accurately capturing and storing data from loan documents. This ensures that the data meets regulatory standards. OCR also makes auditing easier. It provides a digital trail of processed documents. This simplifies compliance verification in audits.

6. Loan servicing and document management

OCR technology speeds up loan servicing. It automatically manages loan documents from start to finish. This includes updating records, handling payments, and communicating with borrowers. Automated management ensures that all information is accurate and accessible. This boosts efficiency and effectiveness.

7. Customer onboarding and KYC compliance

OCR technology speeds up loan servicing. It automatically manages loan documents from start to finish. This includes updating records, handling payments, and communicating with borrowers. Automated management ensures that all information is accurate and accessible. This boosts efficiency and effectiveness.

8. Loan portfolio analysis and reporting

OCR technology enables better loan portfolio analysis and reporting. It does this by digitizing and organizing lots of loan data. Financial institutions can use OCR to get key metrics and insights from loan documents. While it has detailed analysis and report generation, it also ensures that the institutions make better plans and decisions.

Different types of data that can be extracted from loan documents using OCR

Optical Character Recognition (OCR) technology makes loan processing faster and more accurate. It can extract various data from loan documents, which include:

- Personal information: OCR can accurately extract personal details. These include names, addresses, dates of birth, and Social Security numbers, which come from loan applications and identification documents.

- Financial data: Financial data includes income statements. It also includes tax returns, bank statements, and credit scores. They can be digitized and analyzed using OCR, which assesses an applicant's financial health in depth.

- Loan-specific information: OCR efficiently captures details about the loan, including loan amounts, interest rates, repayment terms, and schedules. This ensures precise and organized records.

- Legal and regulatory documents: OCR technology reads legal documents and forms. It makes sure that the industry standards are met and captures essential legal information for due diligence.

- Property or collateral information: OCR can extract data about property or collateral, including property deeds, appraisal reports, and insurance documents. This helps in evaluating and managing collateral.

- Correspondence and communication: OCR can scan and save communication records, such as emails, letters, and notices. It ensures that all borrower interactions are accurately documented and easily found.

- Miscellaneous data: Using OCR, you can also extract employment verification, references, and supporting documents, giving a full view of the loan application.

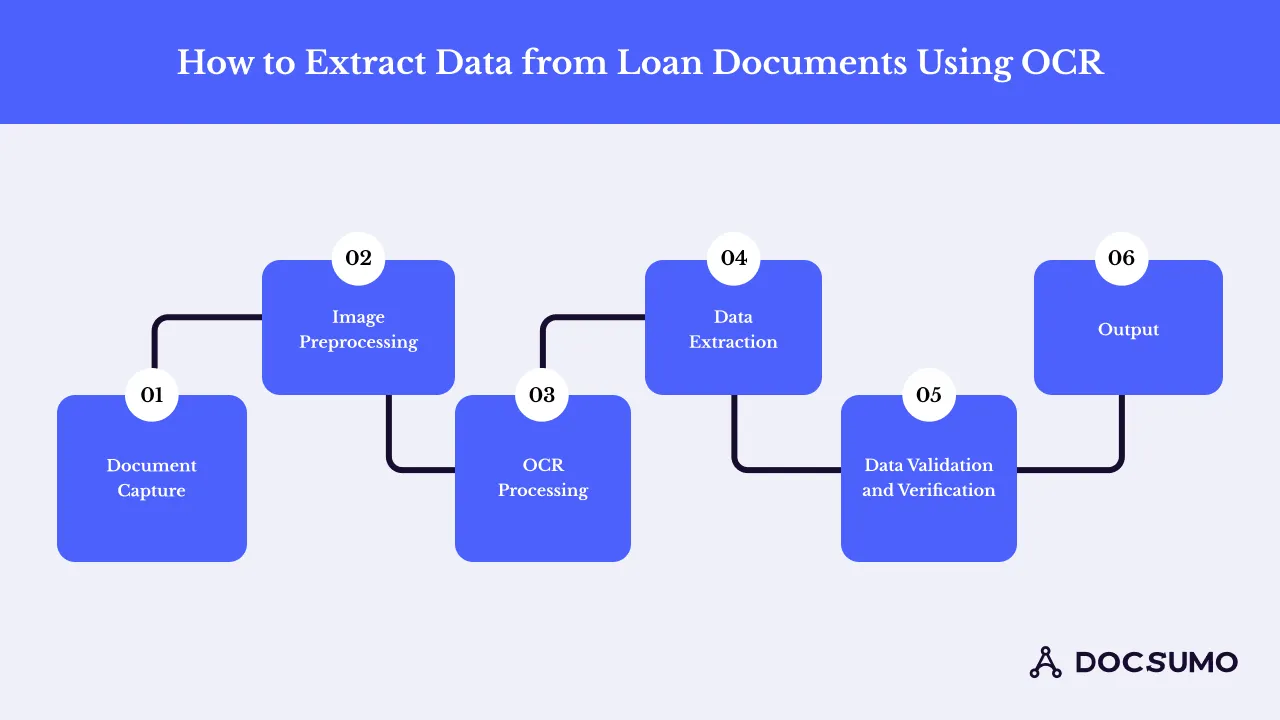

How to extract data from loan documents using OCR

Here’s a step-by-step guide on how to effectively use OCR software:

Step 1. Document capture

The first step in using OCR technology for loan processing is to capture the documents. OCR scans the physical documents or imports the digital files into the system.

For example, when a client submits a paper loan application, the bank scans it with a high-resolution scanner. This makes the text clear and readable. Images are saved in PDF or TIFF formats. This ensures OCR software can read them, maintaining document quality and integrity.

The process:

- Scanning: Use a high-quality scanner or digital imaging device to create precise digital copies of the loan documents. This prevents errors and captures all important details.

- Quality assurance: Poor scans make it hard for the computer to recognize the text. Make sure the scanned documents are clear and legible. Avoid blurry or distorted text, as it's crucial for accurate OCR.

- File format: Save the scanned images in a compatible format like PDF or TIFF, which are specifically designed for OCR. This ensures that the digital copies can be read and processed by computers, making it simpler to extract and analyze the data.

Step 2. Image processing

The scanned images are preprocessed to boost their quality. This includes straightening, reducing noise, and adjusting contrast. Such tasks ensure the text is easily readable, which is key for accurate OCR.

The process:

- Straightening: The skewed images are corrected to ensure the text lines are horizontal. For example, if a loan agreement is scanned at an angle, image processing tools can automatically straighten the document.

- Noise reduction: Removes visual noise. This includes speckles or artifacts that could interfere with the text recognition. For example, older documents might have background noise or marks that need to be cleaned up.

- Contrast adjustment: The contrast between the text and the background is adjusted to make the text more readable. This is important for documents where the text is faint or the background is too dark.

Step 3. OCR processing

Next, the OCR software analyzes the prepared images. It identifies and converts text into machine-readable formats. Further, the OCR engine recognizes characters, words, and lines.

The process:

- Character recognition: The OCR software detects individual characters and converts them into digital text. For example, it reads each letter and number in a scanned bank statement.

- Word and Line detection: The software groups characters into words and lines, which helps maintain the document's structure. For example, a mortgage statement will have its financial figures and descriptions accurately captured.

Step 4. Data extraction

The OCR-processed text is now ready for data extraction. The tool identifies fields like personal information, financial data, and loan details. Advanced OCR systems automate this process using templates and rules.

The process:

- Template definition: Defines the layout of the document using OCR templates.

- Rule application: The tool applies rules to extract key information such as personal details, financial data, and loan specifics.

- Automation: Advanced OCR systems automates data extraction based on predefined templates and rules.

Step 5. Data validation and verification

The extracted data is checked for accuracy and completeness. This includes comparing it against existing databases or doing manual checks. Validation is key to spotting and fixing errors or inconsistencies.

The process:

- Comparison with existing databases: Check the extracted data against existing records to confirm its accuracy. For example, verify that the applicant's Social Security number matches the one in the lender's database.

- Manual checks: Perform manual verification if necessary to catch any discrepancies that automated processes might miss. For instance, a loan officer might review the extracted data to ensure it accurately reflects the information on the original document.

- Error identification: Identify and correct any errors or inconsistencies in the extracted data. This step ensures that all information used in the loan processing is reliable and accurate.

Step 6. Output export

Finally, the validated data is exported to the preferred format or system, like a loan management system, database, or spreadsheet. Ensure it's organized for easy access and processing.

The process:

- Integration with loan management systems: Transfer the data to a loan management system. This allows for easy processing and decision-making.

- Database entry: Save the data in a central database. This simplifies retrieval and analysis.

- Spreadsheet export: Export the data to a spreadsheet for detailed analysis and reporting. This helps in analyzing loan application trends or preparing regulatory reports.

Streamline your loan workflow with Docsumo!

Automate data extraction, reduce errors, and integrate seamlessly.

Conclusion

OCR technology is a game-changer for loan processing automation. By automating data extraction, OCR significantly enhances efficiency, reduces errors, and ensures compliance with regulatory standards. This transformative impact streamlines operations and positions loan processing companies to stay competitive.

Boost your loan processing efficiency with OCR

Stay ahead of your competitors by reducing processing times with OCR.

Frequently Asked Questions

Is OCR accurate for processing loan documents?

Yes, advanced OCR systems provide high data accuracy, minimizing errors. These systems continually learn and improve through machine learning, enhancing their precision over time and ensuring reliable data extraction from complex and varied document types.

What types of documents can OCR handle in loan processing?

OCR can process a wide range of documents, such as loan applications, financial statements, contracts, identification documents, and credit reports. It can handle handwritten and printed texts, making it versatile for various document formats used in loan processing.

How does OCR help with compliance in loan processing?

OCR ensures accurate data extraction, essential for regulatory reporting and compliance. It helps maintain consistent data formats and detailed digital records, making it easier to prepare for audits and ensure all regulatory requirements are met, thus reducing compliance risks.

.png)

.webp)

.webp)

.webp)

.webp)