Processing invoices was a frustrating nightmare for Valtatech. Every month, a tidal wave of 40,000+ unstructured invoices from over 60 vendors with 100+ templates deluged their team. Manually scanning, categorizing, and extracting key data from these multi-page invoices consumed over 3 hours per document. With growing invoice volumes, Valtatech struggled with delayed payments, inaccurate amounts, overlooked invoices, and drained productivity. They desperately needed an automated solution capable of simplifying this chaotic mess.

Fast-track accounts payable and minimize incorrect entries with 99% efficient data capture.

- Extract data you need from Invoices, Purchase Orders and other unstructured documents with just a single click.

- Reduce time to process invoices from weeks to minutes.

- Prevent duplicate invoice payments with automated validation checks

Problem statement

Accounts Payable requires your finance and accounting team to manually extract and match data from original documents like Invoices or Payment Orders which is time-consuming & error-prone.

Get to know about Intelligent Document Processing in Finance

What docs do we handle?

Supplier invoices

Broker invoices

Bills of lading

Invoices

Hospital bills

Reports Credit memos

Purchase Orders

Expense

Receipts

Vendor

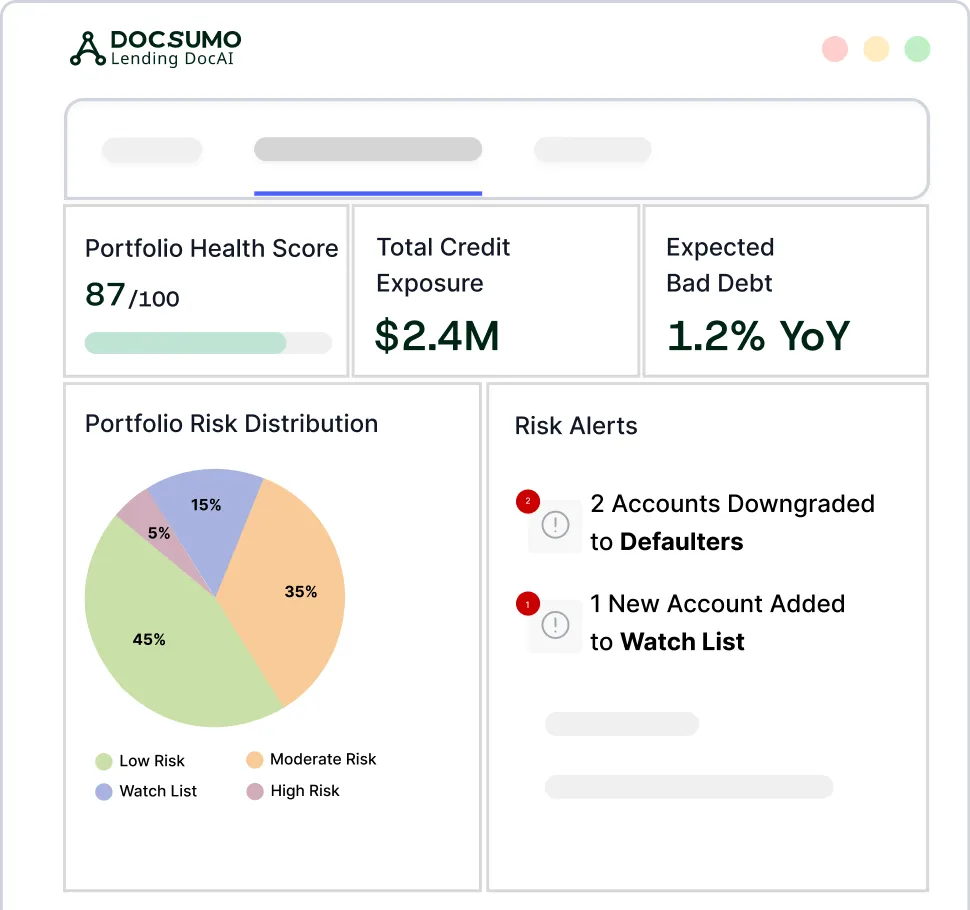

Make your accounts payable touchless, error-free, and accurate

Accounts Payable Case Study

How Valtatech reduced their Invoice processing time from hours to <5 minutes with 99% accuracy

Challenge

Solution

- API-based integration ingests invoices seamlessly into the platform

- Multi-format support structures unstructured invoices

- Advanced OCR accurately extracts all buried data

- Intelligent categorization learns and adapts to new invoice templates

- Custom rules validate extracted data contextually

- Structured JSON output integrates with downstream systems

Results

Intelligent invoice processing eliminated tedious manual tasks, boosted productivity, and enabled Valtatech to scale without expanding headcount.

- Manual processing time was reduced by 95%

- Line item accuracy improved to 99%

- Invoice discrepancies decreased by 90%

30s

processing time of unstructured data reduced to <30 seconds

65%

cost reduction due to accounts payable automation

99%

touchless processing using smart validation rules

See how we can help your finance and accounting team

Let's talk.

Docsumo's intelligent document processing enables you to extract data easily, efficiently, and accurately. Fill up the form to speak with an automation expert.

.svg)

.webp)

.webp)

.webp)

.webp)

.webp)