OCR for Accounts Payable: How OCR Simplifies the Accounts Payable Processing

OCR for Accounts Payable is the use of Optical Character Recognition technology to automate the extraction of data from invoices and other financial documents. Read the blog to learn how OCR streamlines the accounts payable processes leading to improved financial management.

Accounts payable (AP) processing is a crucial aspect of business operations, ensuring that all company obligations to suppliers and vendors are met accurately and on time. Effective AP management not only maintains good supplier relationships but also optimizes cash flow and helps avoid late payment penalties.

However, the manual handling of invoices and other payable documents can be time-consuming and prone to errors, leading to inefficiencies and financial discrepancies.

Optical Character Recognition (OCR) technology presents a transformative solution to these challenges. OCR simplifies the AP process by automatically converting scanned or digital documents into editable and searchable text, drastically reducing the need for manual data entry. This automation enhances the accuracy and efficiency of AP processing, allowing businesses to focus on more strategic activities.

In this blog, we will explore the significance of OCR in accounts payable processing, delve into the mechanics of how it works, and highlight its numerous benefits. Additionally, we will address common challenges associated with OCR implementation and provide a step-by-step guide on using OCR for AP document extraction.

By the end of this article, you'll have a comprehensive understanding of how OCR can streamline your AP processes, ultimately driving better financial management and business growth.

What is OCR in Accounts Payable?

OCR technology involves the electronic conversion of images of typed, handwritten, or printed text into machine-encoded text. It automates the process of extracting and manipulating relevant information from documents, which saves time, reduces errors, and opens up avenues for higher-value business activities.

In the context of accounts payable, OCR can be used to digitize invoices, receipts, purchase orders, and other financial documents. This technology enables businesses to transform these documents into editable and searchable formats, facilitating faster and more accurate data management and retrieval.

By using OCR in accounts payable, businesses can automate the data extraction process, significantly reducing the time and effort required for manual data entry. OCR technology can accurately capture details such as vendor information, invoice numbers, dates, line item descriptions, quantities, and prices from scanned or digital invoices.

This can majorly speed up the AP process and minimize errors, which improves overall data accuracy. It also facilitates compliance with greater ease and enables teams to take up more higher-value activities.

Manual AP processing often faces challenges like data entry errors, processing delays, and a lack of visibility into financial transactions. These issues can lead to financial discrepancies and inefficiencies, making it essential to adopt advanced technologies like OCR to streamline the process.

To fully understand the impact of OCR on Accounts Payable, let's explore why Accounts Payable process automation has become critical for businesses in today's competitive landscape.

Accounts Payable Process Automation: Why is it critical?

In the current digital age, you can generate purchase orders, make payments, reconcile accounts payable, and even look up vendor information with a few mouse clicks and keyboard strokes. Other reasons to prefer automated systems over manual processing are increased efficiency, reduced errors, simplified workflow, and a complete audit trail.

Furthermore, they can generate reports that can be used by management and auditors, providing valuable insight into accounts payable activity. Automation also reduces overall costs by reducing the staff required to run the function.

There are two main steps to accounts payable automation:-

1. Setting up Vendors and Tracking Accounts

The first step in automating your accounts payable process is getting your vendors set up in the system. You need to think about how you use vendors:-

- Do you have just a few large ones or many small ones?

- Are there any special considerations for each one?

- Do you have any recurring invoices from vendors that need to be paid automatically?

When setting up your vendors, add as much detail as you can, including their names, addresses, tax IDs, and contact information. Also, make sure to include the item numbers for each vendor.

You need these details to track payments and expenses. If a vendor doesn't have an item number, you can create one for them.

2. Capturing Data and Making Payments

When you receive a PO, invoice, or purchase order, you need to break out the fields that are relevant to your workflow and add them to your system.

That includes fields like:-

- Vendor ID

- Vendor name

- Vendor address

- PO number

- PO date/time

- Invoice amount

- Due date, etc.

Once you've captured this data, you can proceed to make payments.

This is where an automated solution can save you a lot of time and keystrokes.

To address the critical need for Accounts Payable automation, Optical Character Recognition (OCR) technology plays a vital role in streamlining key processes and enhancing efficiency.

The Role of OCR in Accounts Payable

OCR software can play a pivotal role in automating and improving efficiency in accounts payable processing across the various components and steps involved.

For example, OCR can capture and extract relevant invoice data as soon as it is received, whether in paper or digital format. This immediate digitization allows for faster processing and reduces the risk of lost or misplaced invoices.

Once the invoice data is captured, OCR software can also cross-check and validate the extracted information against purchase orders, contracts, or other relevant documentation to ensure accuracy and validity. This step helps in identifying discrepancies early on.

Additionally, OCR systems can route invoices to the appropriate personnel for approval based on predefined workflows. Automated notifications and reminders ensure timely approvals, preventing bottlenecks in the process.

The OCR system can also easily integrate with existing accounting and ERP systems to ensure prompt and accurate payments, with everything tracked in one place. Automated payment processing reduces manual intervention and the potential for errors.

The integration of OCR in AP processes not only accelerates these steps but also provides real-time visibility into the status of invoices and payments, enhancing overall financial control and efficiency.

Now, let's examine the significant advantages that OCR technology delivers within the context of Accounts Payable processing.

Benefits of OCR Software in Accounts Payable Processing

There are several benefits to deploying automation in the accounts payable process. The accuracy and efficiency that OCR can bring to the accounts payable process are primary reasons for integrating it into your financial workflow.

OCR speeds up the processing of invoices, significantly reducing cycle times. Automated data extraction eliminates the need for manual data entry, allowing AP staff to focus on more strategic tasks.

By minimizing human intervention, OCR also reduces data entry errors and discrepancies. Accurate data capture ensures that financial records are reliable and consistent.

Both of the above can lead to significant cost savings. Automating the AP process with OCR reduces labor costs associated with manual data entry and document handling. It also helps avoid late payment penalties by ensuring timely invoice processing.

Finally, OCR can provide real-time insights and analytics derived from processed financial data. This visibility enables better financial planning, budgeting, and decision-making.

While OCR offers numerous advantages, it's crucial to acknowledge and address the potential challenges that may arise during its implementation in Accounts Payable processing.

Challenges of Using OCR in Accounts Payable Processing

While OCR technology presents significant advantages in automating and streamlining accounts payable (AP) processes, it can also present challenges. Knowing them in advance helps you address them effectively through implementation.

1. Accuracy Issues

One of the primary challenges with OCR technology is its accuracy in interpreting documents. OCR may struggle with handwritten or poorly scanned documents, leading to errors in data extraction. This issue is particularly problematic in AP processing, where accuracy is paramount.

High-quality document images are thus essential to mitigate these challenges, and businesses can invest in proper scanning equipment and practices to ensure clarity and legibility. Additionally, ongoing advancements in OCR technology, such as the incorporation of machine learning algorithms, are continually improving the accuracy of data capture, even for less-than-perfect documents.

2. Integration Complexities

Integrating OCR software with existing accounting systems and workflows can be a complex and daunting task. Many businesses have established AP processes and systems that are deeply ingrained in their operations. Therefore, any new technology must seamlessly integrate without disrupting existing workflows.

Choosing an OCR solution with robust integration capabilities is crucial. Businesses should look for OCR software that offers flexible APIs, compatibility with various accounting platforms, and the ability to customize the integration to fit their specific needs. Comprehensive planning and collaboration between IT and finance departments is what facilitates smoother integration.

3. Compliance Concerns

Ensuring compliance with data privacy and security regulations is another critical challenge when implementing OCR in AP processing. Financial documents often contain sensitive information that must be protected according to regulatory standards. The OCR software must adhere to stringent data security protocols to prevent unauthorized access and data breaches. Compliance with regulations such as GDPR, HIPAA, and others is non-negotiable.

Businesses should select OCR solutions that offer such robust security features, including data encryption, secure data storage, and regular security audits to ensure ongoing compliance. Your financial and compliance teams should also work together to review which legal codes and regulations are necessary to adhere to so that they can make an informed choice on an OCR software that actually works for your business.

4. Handling Non-standard Documents

OCR software can struggle with processing non-standard or atypical invoice formats, such as those with unconventional layouts, multiple languages, or non-standardized data fields. This variability can lead to inaccuracies and incomplete data extraction.

Customization and training can help improve OCR performance in these cases. Businesses may need to work closely with their OCR software providers to customize the software to recognize and accurately process their specific document formats.

Additionally, staff training is essential to ensure they can handle exceptions and anomalies effectively.

5. Training and Maintenance

Effective use of OCR software requires proper training for accounts payable staff. This training ensures that staff can use the software efficiently and interpret results accurately. Initial training can be time-intensive, and ongoing training may be necessary as the software evolves and updates.

Regular maintenance and updates to the OCR software are also essential to ensure optimal performance and to incorporate the latest technological advancements. Businesses should be prepared to invest in training programs and maintenance schedules to maximize the benefits of OCR technology.

Despite these challenges, the benefits of OCR in accounts payable processing far outweigh the difficulties when implemented thoughtfully and strategically. By addressing accuracy, integration, compliance, document variability, and training issues, businesses can harness the full potential of OCR technology to transform their AP processes, leading to greater efficiency, accuracy, and cost savings.

Despite the challenges, effective implementation of OCR within Accounts Payable processes requires a strategic approach. Let's explore key strategies for optimizing your Accounts Payable workflow.

How to Optimize Your Accounts Payable Process?

The AP department is no longer a back-end function and has become strategically valuable to businesses. An efficient accounts payable process leads to positive cash flows and supplier relations. It also levels up your operations and profitability.

Let us explore the strategies that can help optimize your accounts payable process.

1. Digitalize Invoice Processing

The invoice processing function in finance departments follows a somewhat similar process:

i) Vendors share an invoice.

ii) Finance does manual data entry into accounting software.

iii) Documents go through an approval process.

iv) Finally, the Payment is released.

Manually implementing these tasks is time-consuming, error-prone, and demands significant resources. Releasing the payment to a vendor might take weeks or months, hurting their cash flows and your long-term relations.

On the bright side, intelligent invoice processing platforms are changing the game for AP professionals. An intelligent invoice processing software uses OCR & intelligent data extraction to automate matching invoices against purchase orders, receipts, and approval workflows. With these platforms, you can avoid errors, delays, and late fees and rapidly process invoices while maximizing visibility and improving accuracy.

They can help your AP team focus more on strategic tasks like cash flow analysis and forecasting.

2. Integrate accounting software with the accounts processing system

Your finance team uses accounting software for bookkeeping and more than one tool to manage approvals, collect invoices, and create reports. But do they still manually enter and tweak data most of the time?

If so, consider an Accounts Processing Automation software that can integrate with your existing accounting software. By ensuring ready integrations to push data in the matching schema, your team can save precious hours and avoid manual tasks.

3. Increase visibility through better reporting and analytics

CFOs are taking stock of data and analytics to stay competitive and gain better visibility into every aspect of their finance department. According to a report by PWC, 68% of CFOs are investing in digital transformation, including in technologies like cloud and analytics. They seek to make more strategic decisions by leveraging AI and ML-based automation to accelerate revenue growth.

An intelligent AP automation platform offers intuitive data visualization that makes it easier to draw insights. It allows you to focus on strategic decision-making backed by data. With granular analytics, you can identify and solve bottlenecks in your AP process.

4. Implement fraud prevention protocols and internal controls

Implementing fraud prevention protocols and internal controls is critical, especially in the Real Estate and BFSI sectors. Due to the large volume of transactions and high dollar amounts in these sectors, unauthorized payments and fraud are more likely. These industries are subject to stringent regulations by governing bodies like NAR and FTC to protect consumers and prevent financial fraud.

AP automation tools help companies prevent fraud through audit trails, segregation of duties, and integration with procurement teams. Since these automation tools also work with third-party vendors, check for SOC certifications to ensure they comply with data protection and cybersecurity standards.

So far, we have understood the essential steps to optimize accounts payable processes. Now, let us explore the KPIs that help us further evaluate our AP process.

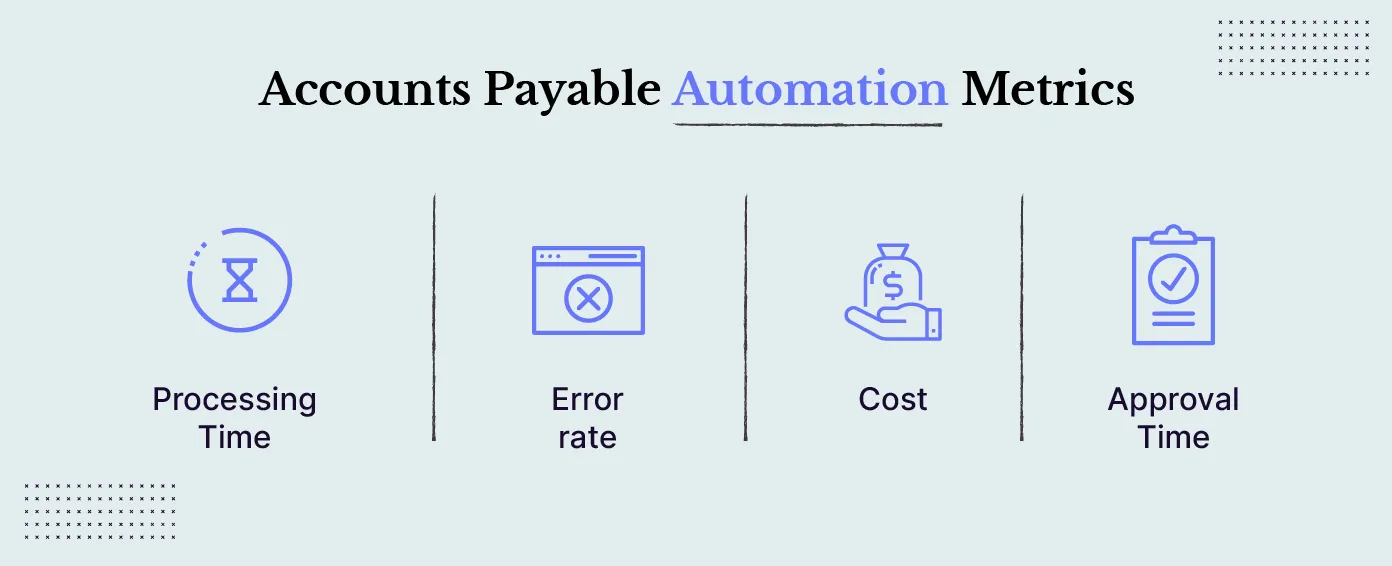

What are the Important AP Automation Metrics?

When automating accounts payable processes, one must look at some key metrics to assess automation success:-

1. Invoice processing time

This metric measures the time to process an invoice, from receipt to payment. While automating the AP process can significantly reduce the time taken to process invoices, measuring the processing time helps you gauge productivity.

2. Error rate

Keep an eye on your invoice error rate post-automation. It is a critical metric to track because erroneous or duplicate payments can hurt your company’s bottom line.

3. Cost saving

Cost saving measures the cost of processing an invoice. Automation is supposed to reduce the cost of processing invoices by eliminating manual data entry and reducing the need for paper-based processes.

4. Approval time

This metric measures the time taken to approve an invoice for payment. Automation decreases invoice approval times, enabling organizations to pay vendors more quickly and efficiently.

Now that we've established the key metrics for measuring AP Automation success let's explore the diverse range of Accounts Payable documents that can be effectively processed using OCR technology.

Different Types of Accounts Payable Documents That Can be Extracted Using OCR

OCR technology can extract valuable data from various accounts payable (AP) documents, enabling automation and streamlining of AP processes. Some of the common documentation that benefit from OCR are:

1. Invoices

OCR can capture key invoice data such as vendor information (name, address), invoice number, invoice date, line item details (description, quantity, unit price, total amount), tax information (if applicable), and more.

Automated data extraction from invoices helps in reducing manual data entry errors and processing time. It ensures that invoices are processed promptly and accurately, facilitating timely payments and improving vendor relationships.

2. Purchase orders (POs)

OCR software can extract critical information from purchase orders, including purchase order numbers, vendor information, item descriptions, quantities, and prices.

By automating the extraction of PO data, OCR enables seamless matching of invoices to POs, ensuring that goods and services are accurately billed and reducing discrepancies in payments.

3. Receipts

OCR technology can extract transaction details from receipts, such as transaction date, merchant information, amount spent, payment method, and more.

Automated receipt processing simplifies expense reporting and reconciliation processes, ensuring accurate accounting of business expenditures and compliance with expense policies.

4. Contracts and Agreements

OCR can extract key terms and conditions from contracts and agreements, including details about parties involved, contract start and end dates, payment terms, contract values and obligations.

Automated extraction of contract data helps in managing contract lifecycles, tracking payment milestones, and ensuring compliance with contractual obligations.

5. Statements and Reports

OCR software can extract data from financial statements and reports, such as account balances, transaction details, summary information, etcetera.

Automated extraction of financial data from statements and reports facilitates faster financial analysis and reporting, enabling businesses to make informed decisions based on up-to-date financial information.

6. Tax Documents

OCR technology can extract data from tax documents such as Tax identification numbers (TIN), taxable income details, deductions and exemptions, and more. Automated extraction of tax data ensures accurate and timely tax filings, minimizing the risk of errors and penalties.

7. Shipping and Logistics Documents

OCR can extract data from shipping and logistics documents, such as shipment details, carrier information, tracking numbers, and more.

Automated extraction of shipping data facilitates accurate billing and tracking of shipments, ensuring timely payments to carriers and efficient logistics management.

8. Credit Memos

OCR can extract data from credit memos issued by vendors or suppliers, including reason for credit, credit amount, invoice number and details. Automated credit memo data extraction helps manage returns and adjustments efficiently, ensuring accurate accounting and financial reporting.

9. Payment Remittances

OCR technology can extract data from payment remittances, including invoice numbers, payment amounts, payment reference details, and more.

Automated extraction of payment remittance data facilitates reconciliation of payments, ensuring accurate allocation of funds and improved cash flow management.

10. Compliance and Regulatory Documents

OCR can extract data from compliance and regulatory documents, including compliance certifications, regulatory filings, and audit reports.

Automated extraction of compliance data helps ensure adherence to regulatory requirements and facilitates timely reporting to regulatory bodies.

By leveraging OCR technology to extract data from these various types of AP documents, businesses can automate and streamline their accounts payable processes, reduce manual errors, improve data accuracy, enhance operational efficiency, and achieve significant cost savings.

How exactly does the process of extracting data from various Accounts Payable documents using OCR work? Let's examine the key steps and techniques involved in this crucial process.

How to Extract Data from Accounts Payable Documents Using OCR

OCR (Optical Character Recognition) technology plays a crucial role in automating the extraction of data from accounts payable (AP) documents, enabling businesses to streamline their processes and improve efficiency.

Here’s a detailed step-by-step guide on how OCR software can be used to extract data from AP documents:

1. Document capture

Begin by uploading or scanning physical invoices, receipts, purchase orders, and other AP documents into a digital format. Alternatively, upload existing digital documents to the OCR software.

2. Image Preprocessing and Enhancement

The OCR software preprocesses the scanned images to enhance readability and clarity. This includes:

- Deskewing: Adjusting the orientation of the document.

- Noise Reduction: Removing background noise and imperfections.

- Contrast Adjustment: Enhancing the contrast between text and background.

- Image Cropping: Removing unnecessary borders or edges.

3. OCR Processing

The OCR software performs optical character recognition to convert the scanned images into machine-readable text. This includes:

- Text Extraction: Identifying and extracting text data from the document.

- Character Recognition: Recognizing individual characters, symbols, and numbers.

- Language Detection: Identifying the language used in the document for accurate interpretation.

4. Data Extraction

Based on the given inputs, the OCR software extracts the following information.

- Field Mapping: Define fields within the document where specific data elements are located. For example, some text

- Invoice Number

- Vendor Name

- Invoice Date

- Line Item Details (Description, Quantity, Unit Price, Total Amount)

- Tax Information

- Automated Data Extraction: The OCR software automatically extracts data from predefined fields using machine learning algorithms and pattern recognition techniques.

5. Data Validation and Verification

The OCR software validates the extracted data against predefined rules and standards. This ensures the accuracy and integrity of the extracted information. The extracted data is verified by comparing it with the original document to ensure completeness and correctness.

6. Output

You can export the extracted data into structured formats such as CSV (Comma-Separated Values), Excel Spreadsheet, JSON (JavaScript Object Notation), and XML (eXtensible Markup Language).

7. Integration

The extracted data should be integrated with your existing accounting software, ERP (Enterprise Resource Planning) system, or AP automation platform for further processing and analysis.

By following these steps and leveraging OCR technology for data extraction from AP documents, businesses can significantly improve efficiency, accuracy, and cost-effectiveness in their accounts payable processes. This enables them to manage cash flow better, optimize vendor relationships, and support overall business growth.

With an understanding of the data extraction process, let's explore how to choose the right AP Automation software that effectively leverages OCR technology to meet your specific business needs.

How to Choose an AP Automation Software?

Selecting an accounts payable automation software requires careful consideration of your business's goals, industry, existing workflows, and systems.

1. Map out your invoice processing workflow

Account for factors such as the volume and complexity of the documents you process, the number of vendors, and the complexity of your approval process. It is also essential to ensure that the AP automation tool you select complies with regulations such as SOX.

2. Compare different types of data capture platforms

Capturing data from an invoice and making payments are the most critical aspects of accounts payable. You can streamline these tasks for optimal expense management and cash flow. An invoice processing software is tailored for this purpose.

While multiple kinds of invoice processing software exist, we will focus on the two most dominant ones.

Template based OCR

A template-based-OCR invoicing software uses predefined templates to recognize and extract data from structured documents such as invoices, purchase orders, and receipts. By using predefined templates, the software can quickly and accurately extract data from each document, reducing the need for manual data entry and minimizing errors.

However, this software falls short when it comes to processing complex documents. It is ideal for small-scale businesses that deal with similarly structured invoices with minimal variations. Template-based OCR is also priced cheaper compared to more advanced processing software.

Intelligent document processing software

An Intelligent Document Processing software combines powerful OCR, machine learning, and deep learning capabilities. It can process structured as well as unstructured documents and adapt to enormous variations. Besides capturing data, IDP derives context and insights and generates a narrative. Its ML techniques systematically boost accuracy over time.

An IDP platform is recommended for businesses receiving documents in multiple structures, formats, and styles. For example, enterprises in the Insurance, Real Estate, and lending industries that handle high volumes of paperwork such as invoices, receipts, purchase orders, bank statements, and contracts can benefit highly.

To sum it up:

DocSumo: A leading OCR Software for Extracting Data from Accounts Payable Documents

DocSumo stands out for its robust OCR technology and advanced capabilities in extracting data from accounts payable (AP) documents. Its key features are:

Advanced data extraction capabilities: Docsumo utilizes advanced machine learning algorithms and AI-powered OCR technology to accurately extract data from various types of AP documents. Whether it's invoices, purchase orders, receipts, or other financial documents, Docsumo can automatically capture and interpret key data fields such as:

- Invoice Numbers

- Vendor Information

- Invoice Dates

- Line Item Details (Description, Quantity, Unit Price, Total Amount)

- Tax Information

- Payment Terms

Integration options: Docsumo seamlessly integrates with your existing accounting software, ERP (Enterprise Resource Planning) systems, or AP automation platforms. This integration facilitates the smooth transfer of extracted data into your workflow, eliminating the need for manual data entry and reducing the risk of errors.

User-friendly interface: The intuitive user interface of DocSumo makes it easy for AP professionals to upload, process, and validate AP documents. The platform requires minimal training, allowing users to quickly adapt to the software and start benefiting from its efficiency gains.

Customization and flexibility: DocSumo offers customization options to meet specific business needs and document formats. It can handle non-standard invoices and adapt to different layouts or languages, ensuring accurate data extraction regardless of document complexity.

Accuracy and reliability: DocSumo prioritizes accuracy and reliability in data extraction, significantly reducing errors associated with manual data entry. The software's OCR technology is capable of handling handwritten text, poor-quality scans, and variations in document formatting.

Cost-effective solution: By automating the data extraction process, DocSumo helps businesses save time and reduce labor costs associated with AP document processing. This cost-effective solution frees up resources for more strategic initiatives and allows AP teams to focus on value-added tasks.

Real-time insights and analytics: DocSumo provides real-time insights and analytics derived from processed invoice data, offering valuable business intelligence for informed decision-making. By analyzing spending patterns, vendor performance, and invoice processing times, businesses can optimize their AP processes and enhance financial management.

Book a demo now to learn how DocSumo can optimize your business’ accounts payable process.

How Valtech Streamlines Invoice Processing Using DocSumo

Valtatech, a leading managed services provider in the industry, streamlined its invoice processing workflow using DocSumo. By automating data extraction from invoices, Valtatech reduced processing times from a few hours to just a few minutes—with over 99% accuracy. This enabled the AP team to focus on more strategic tasks, improve vendor relationships, and optimize cash flow management.

DocSumo stands out as the best OCR software for extracting data from accounts payable documents due to its advanced capabilities, ease of use, integration options, customization, accuracy, and cost-effectiveness. Businesses looking to streamline their AP processes, reduce manual effort, and achieve greater efficiency should consider DocSumo as their preferred OCR solution.

Conclusion

OCR technology has revolutionized the accounts payable (AP) process by simplifying data extraction from various financial documents such as invoices, purchase orders, and receipts. By leveraging advanced machine learning algorithms and optical character recognition techniques, OCR software like DocSumo enables businesses to automate tedious manual tasks, reduce errors, and enhance efficiency in AP processing.

As OCR continues to evolve and integrate with other technologies, such as artificial intelligence and robotic process automation, its potential to revolutionize AP processing will only grow. Businesses that embrace OCR as part of their digital transformation journey will position themselves for success, gaining a competitive edge and unlocking new growth opportunities.

Book a demo today and discover how DocSumo can transform your accounts payable operations.

Frequently Asked Questions

What is OCR software in accounts payable processing?

OCR (Optical Character Recognition) software in accounts payable processing refers to technology that automatically converts scanned or digital documents into editable and searchable text. This enables businesses to extract key data fields from invoices, purchase orders, and other financial documents, streamlining the accounts payable process.

How does OCR work with your AP automation system?

OCR works with AP automation systems by extracting data from scanned or digital documents and transferring it seamlessly into the AP workflow. The OCR software interprets text and numbers from invoices, purchase orders, and receipts, allowing for automated data entry, validation, and processing within the AP system.

What are the benefits of using OCR in accounts payable?

The benefits of using OCR in accounts payable include Faster processing of invoices and reduced cycle times, Improved accuracy and reduction in data entry errors, Cost savings through the above two, decreased manual effort and labor costs, Real-time insights and analytics for informed decision-making and better financial planning Enhanced compliance with regulatory requirements and audit trails.

Is OCR accurate in extracting data from accounts payable documents?

Yes, OCR technology is highly accurate in extracting data from accounts payable documents, including invoices, purchase orders, and receipts. Modern OCR software utilizes advanced machine learning algorithms to interpret text and numbers accurately, even from handwritten or poorly scanned documents.

Can OCR software handle non-standard documents in accounts payable processing?

Yes, OCR software like Docsumo can handle non-standard documents in accounts payable processing. The software offers customization options to adapt to different document layouts, formats, and languages, ensuring accurate data extraction regardless of document complexity.

.webp)

.webp)

.webp)

.webp)