Suggested

Bank Statement Extraction: Everything You Need to Know

Bank statement extraction process involves advanced technologies like OCR and AI to convert PDF bank statements into usable data. Read the blog to learn the process of data extraction from bank statements, its challenges and ways to automate it.

The manual process of extracting and organizing data from bank statements can be tedious and error-prone. Inefficient conversion methods can lead to reconciliation delays, inaccurate financial reporting, and wasted time.

Businesses are turning to bank statement converter software to address this pain point. These tools automate the conversion process, making it faster, more accurate, and less labor-intensive.

In this article, we will explore everything you need to know about bank statement extraction, from its working to different types of software available in the market to highlighting its features and benefits. Moreover, we will also help you understand and decide how software solutions like Docsumo can help your business’s financial operations.

So, let’s start with the basics and move on to more important things.

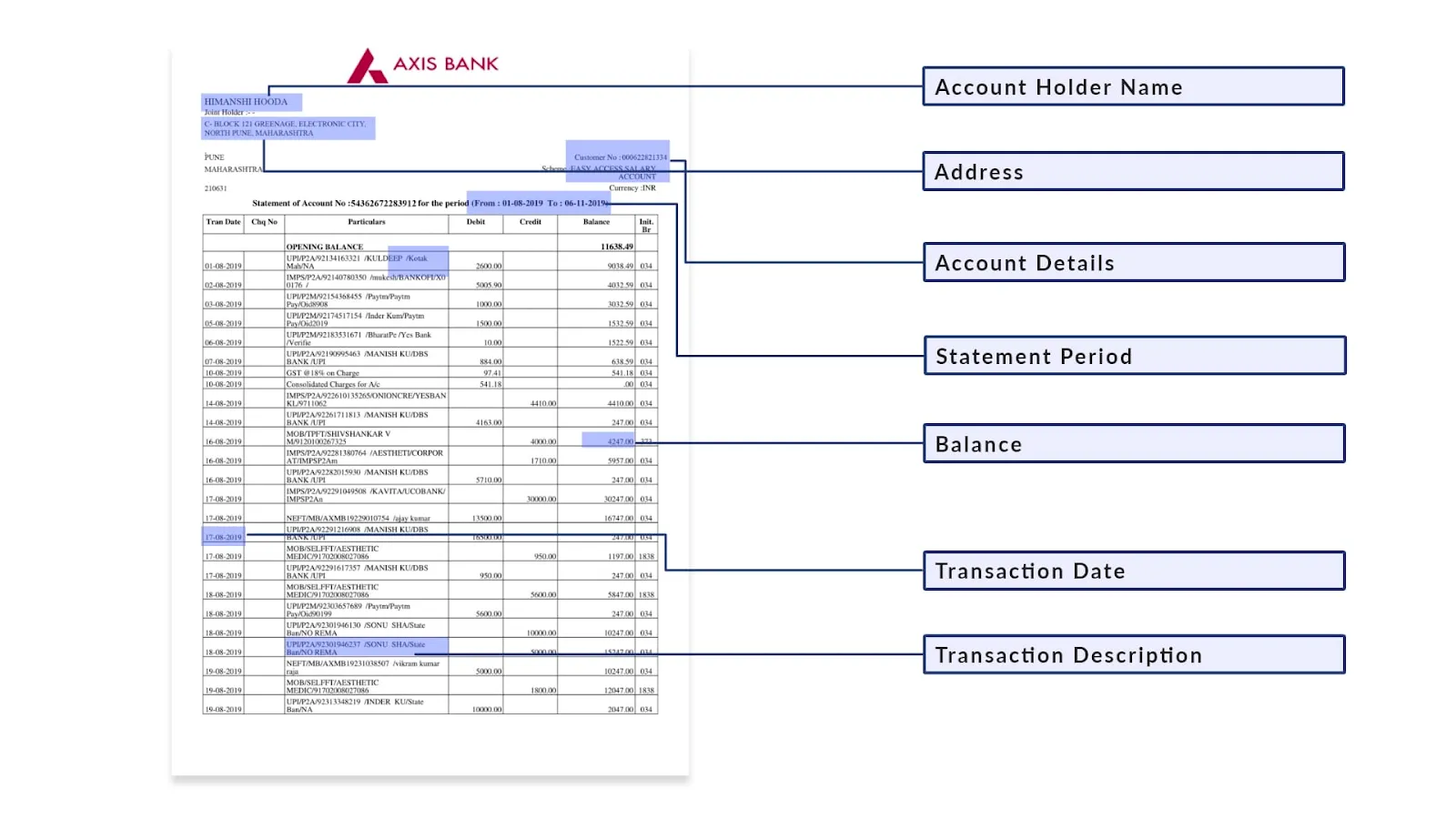

Bank statements offer an overview of the customer’s financial transactions, and their online versions often come in PDF format and are secured by a passcode. Finance managers skim through these statements to gain insights into spending patterns, identify potential cost savings areas, analyze cash flows, and monitor account balances.

Underwriters use it to assess an applicant's financial health, verify income and expense levels, and evaluate creditworthiness.

Banking and finance organizations use bank statements to identify spending patterns, improve tax reports, validate large transactions, conduct reconciliations, and highlight cash outflows.

To streamline the management of these critical financial documents, many businesses rely on a specialized tool: bank statement converter software. Let’s see what are bank statement converter software in the next section of the blog.

A bank statement converter tool converts bank statements into Excel, CSV, JSON, or other preferred formats and extracts and processes data from structured, unstructured, and semi-structured documents.

The following two stages require human intervention:

1. Uploading the bank statements

2. Final review of the converted data

The software streamlines data extraction and data processing for businesses by handling these repetitive manual tasks.

To fully appreciate the benefits of bank statement converter software, let's examine the challenges associated with manual bank statement processing.

The traditional notion of 'human touch' serving as the final seal of approval is no longer trustworthy - at least in accountancy. Not only does manual processing eat up precious time in today's fast-paced world, but it also comes accompanied by a whole bag of other limitations as well:-

The monotonous, mundane task of number crunching plays tricks on the human mind, leaving room for errors and mistakes in processing bank statements manually. Errors can occur in:

An error in even a single digit or decimal tends to create a snowball event where all subsequent processes take the hit. Moreover, it becomes nearly impossible to pinpoint the error location to fix inaccuracies.

While bank fraud prevention laws and protocols are very well put together, the legacy of manual bank statement processing, unfortunately, has still left behind a trail of fraudulent practices that garner a bad name:-

Today, there is a need for speed in all tasks and operations of a business in order to stay at the top of the game. Manually importing bank statements to Excel is an agonizingly slow process riddled with compromises and errors. Data labeling also takes up precious man-hours that can be utilized effectively elsewhere.

Setting an exclusive budget for a dedicated team to process your bank statements puts a dent in your finances - and this is just the direct cost of manual operations. Bearing in mind the errors and inaccuracies that could occur down the pipeline and subsequently lead to consequential costs. According to estimates, manual document processing can cost somewhere between 170% to 20 times the automated document processing costs.

Manual intervention in bank statement processing allows data leaks to occur, which are risky in the world of business - where the competition can do anything to get ahead. Sensitive financial data must never be allowed to leave your offices.

Given the significant drawbacks of manual processing, it's clear that bank statement converter software offers numerous benefits for businesses of all sizes. Let's examine these benefits in more detail.

Investing in an automation tool for converting bank statements can be time-saving. For example, financial professionals who help clients with tax filing at the end of the financial year have limited time. The situation gets tough with multiple clients.

Depending only on humans to convert bank statements in Excel formats is prone to errors and time-consuming. Using a tool with humans in the loop can save time. Instead of spending days or weeks manually inputting this data, the bank statement converter processes documents in 30-60 seconds.

Distractions from the work environment and boredom due to monotonous tasks might lead to manual data conversion errors.

Automated data extraction offers more than 99% accuracy in data conversion. Hence, your team can verify the extracted data and flag discrepancies to reduce data errors and fraudulent changes.

Bank statement formats may vary bank-wise. Though humans adapt to different formats and types of bank statements, extracting data from a different format is time-consuming. They must understand the documents, locate the information, and convert them.

On the other hand, the bank statement converter extracts data from different formats and information within seconds.

Document-heavy businesses require significant human resources for data processing. Document processing software operates 24/7 to extract data, regardless of document volume. This reduces operational costs by 60-70%. The ROI increases, and the staff can focus on more strategic tasks.

Bank statement converters are versatile tools that go beyond conversion. They integrate with various applications, facilitating real-time data flow and reducing errors. They support multiple file formats, ensuring compatibility with accounting software.

A bank converter solution extracts data and processes information faster than manual efforts.

For example, automated document processing using IDP (Intelligent Document Processing) in the lending industry helps process documents faster, allowing the loan officer to get faster loan approvals. Customers can immediately hear back about their loan application, thus improving the overall customer experience.

To further understand the impact of bank statement converter software, let's explore some specific use cases that demonstrate its value across different industries.

Lending institutions receive bank statements from thousands of borrowers for loan applications. They can convert PDF bank statements into Excel formats to easily access the borrowers' income, check the accuracy of data, and reduce the turnaround time for loan approval.

Auditors must reconcile bank statements, analyze taxes, and scrutinize their client's finances. Under a tight deadline, converting PDF bank statements into JSON formats helps them verify the data quickly to file taxes for their clients.

Business owners must track income, expenses, and payroll to manage finances effectively. Bank statement converters streamline this process by digitizing statements, enabling easy reconciliation, tracking cash flow, and integrating accounting software.

To ensure the most accurate and efficient data extraction, proper preparation of your PDF bank statements is crucial. Let’s learn about it in the next section of the blog.

Despite the inherent complexities associated with financial data extraction from PDF bank statements, there are effective strategies to overcome common obstacles.

Here’s how data is extracted from bank statements.

Intelligent document processing software uses advanced image recognition software to deskew the images, reduce noise, and convert the file into grayscale to prevent colors from interfering with the data extraction.

Most automated data capture tools come with either rule-based or ML-based solutions.

Despite careful preparation, certain challenges can arise during the data extraction process from PDF bank statements. Let’s evaluate them.

The most common issues that plague the data capture process for PDF bank statements are:

PDF bank statements are often encrypted with passwords to ensure data security. However, this can hinder data extraction efforts. Prior to extraction, it is essential to have the necessary credentials to unlock password-protected PDFs or obtain unencrypted versions for seamless data extraction.

In addition to images, text, and figures, PDF bank statements contain tables, wherein lies important information. A PDF converter processes the entire document without providing an option to limit the data extraction to specific sections in the PDF, such as specific columns and rows.

Docsumo’s advanced AI/ML algorithm and OCR technology help financial institutions effortlessly convert bank statements into actionable findings. Here’s a breakdown of how easy it is to extract data from bank statements using this intelligent platform:-

Upload the unencrypted PDF bank statement to the Docsumo platform. The pre-trained APIs identify key information, like account numbers, transaction IDs, summary tables, and transaction amounts.

Docsumo's advanced data capture algorithms, powered by AI and OCR, start the extraction process. The key information is intelligently extracted from the statements.

The extracted data from the bank statements is sent to the relevant department for thorough review and approval. Docsumo's API ensures 99% data accuracy throughout the process. It also highlights mismatched entries, allowing the authorities to validate the information with ease.

Any exceptions or unforeseen errors are immediately flagged, and the platform automatically notifies the respective personnel for the manual verification of the extracted data. The ML algorithm records these adjustments and uses them to refine its future processes.

To further understand the impact of Docsumo's bank statement processing solution, let's explore a real-world example.

Case Study: Hitachi Streamlines Bank Statement Reconciliation using Docsumo

Hitachi, a white-label ATM provider, was overburdened with the volume of monthly bank statements sent to them by their ATM operators. It had become challenging for them to manually process over 3000+ bank statements every month. This is where Docsumo intervened and streamlined its processes. So, what were the challenges, and how did Docsumo alleviate their reconciliation concerns?

This real-world example highlights the significant benefits of implementing a robust bank statement converter solution. Now, let's explore how to select the best software for your organization.

The key things to look for in bank statement converter software are:

This process can get time-intensive. So, invest in an automation tool that integrates OCR with artificial intelligence (AI) or uses IDP technology to learn and adapt to different modifications of bank statements by itself.

Docsumo streamlines data extraction from bank statements and simplifies the workflows for financial institutions, mortgage lenders, and insurance companies. What sets Docsumo apart from the rest of bank statements data capture platforms is-

If you’re looking for a reliable platform to distill the important information from bank statements, sign up for a 14-day free trial.